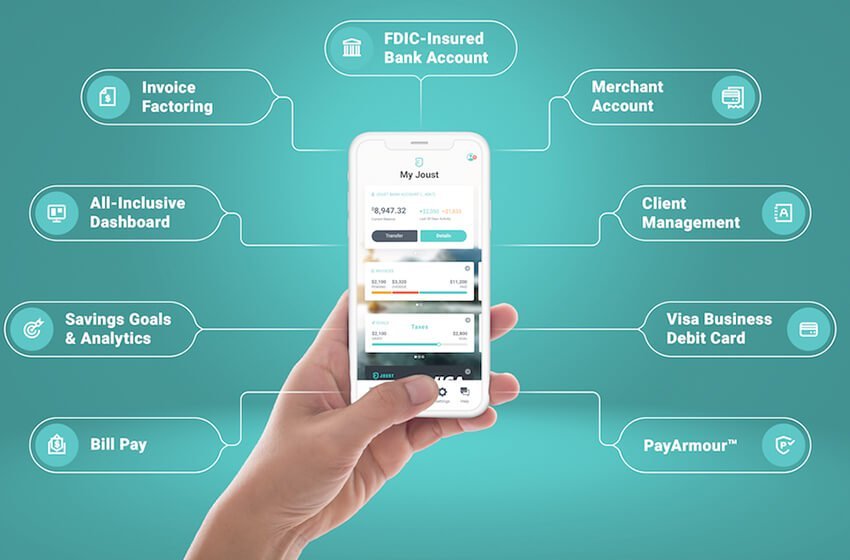

Joust has unveiled its new improved banking app for freelancers and self-employed workers. The new app by the sole banking platform for freelancers comes with an intuitive design and several features that round out its original beta app. According to the developers, the application is based on customer feedback. For example, it incorporates features such as an analytical dashboard, Joust Visa debit card management, invoice creation/payments, and more.

The Denver based fintech’s application launch was brought about by the rapid increase in independent workers seeking a wide range of new financial services. For example, the new features help manage clients, accept a range of payments through credit cards, and mitigate the risk of irregular income.

New Joust Banking App for Freelancers, Self-Employed

Joust’s application will continue to use its invoice-guaranteeing product, PayArmour, which funds unpaid client invoices, and its FDIC-insured bank account combined with a merchant account.

Catering to the Growing Gig Economy

As a result, the app will come in handy for the booming freelance sector in America. For example, there are currently 57 million freelancers in the US working today. This figure is expected to double by 2027 with more of the country’s workforce expected to freelance in some capacity.

“Our users are risk-takers who want one place to easily manage their finances, so they can have the time and space to focus on their passions. They wanted a modern, streamlined user experience, ways to quickly visualize their finances, and manage clients, income and payments,” said Lamine Zarrad Joust’s CEO and Co-Founder.

The app’s major selling point is its invoice protection tool that resolves late or non-payment of dues by clients.

How Will it Change Payment for Freelancers?

The revamped application can now offer freelancers and small businesses more robust banking and financial management services. Through the launch of the application, Joust is trying to simplify finances and make them less taxing for freelancers and contractors. Thus, offering individuals and small businesses with banking services previously reserved for big companies.

This in effect will help cut costs in regards to hiring dedicated teams for financial management.As a result, it will allow room to focus on the work at hand. Joust’s application looks to ease the financial management challenges of freelancers who account for close to 35% of the total U.S. workforce.

In recent years freelancing has become a more prominent fixture in the American economy accounting for almost 5% of the U.S. This GDP is more than the construction and transportation industries combined. Current projections indicate earnings from freelancing could hit the $1 trillion mark. Joust’s new offering seems to be answering to the demand of this sector.

PayArmour and Other Features

Through PayArmour, Joust’s invoice guarantee product helps alleviate client nonpayment. It’s a common problem that affects 71% of the gig economy workforce, according to Joust. As a result, the app will help smooth income volatility with an option to receive same-day funding.

The all-inclusive banking app is designed with the self-employed worker in mind. It comes with a 3-minute onboarding process that allows you to access your Joust bank account in just three minutes. The FDIC-insured bank account covers up to $250,000, and with Bill Pay, you can manage all your expenses in one place.

These include customizable goals accounts that encourage saving and a sleek dashboard to organize your financials. The app comes with a customer service team that can help you navigate through the workings of the application.

Qualified members have the option to get a Joust business debit card. As a result, they get easy card activation, PIN management, and lock/unlock features all in the palm of your hand. Qualified members can also easily process client transactions via bank account transfer or credit card with a Merchant Account.

All these are backed up with a comprehensive and customizable invoicing platform. You can customize your invoices and organize by the different payment processing stage.

Available on Android and iOS

The application runs on both android and iOS devices. Joust will continue to release a host of new app features running throughout 2020. These will include Peer to Peer (P2P) payments, savings goals and remittances, direct deposit, invoice estimate creation, and payment reminders.

Currently, Joust offers a six-month free trial offer with seven core features. For example, features include a custom invoice builder; an invoice tracker; a client management tool, business bank account, savings goals; a merchant account and a P2P payment.

Image: joust.com