When running PPC campaigns or investing precious cash flow into SEO to scale a business, most people are (hopefully) primarily concerned with two things:

Lifetime value (LTV) and cost per acquisition (CPA).

If your main concern is rankings, impressions, or click totals, think again.

Both CPA and LTV are critical key performance indicators for running a smooth operation.

If you don’t know your LTV or CPA, you’re flying blind. You don’t know what moves you should or can make because you have unknown costs. You’re neglecting the big picture.

And when looking to scale your business, both of these KPIs play specific roles.

But which is more important to focus on for bottom line growth?

Here’s the answer and why.

Why Lifetime Value is King

When looking to scale your business by bringing in new clientele, you have a few different options.

You can:

- Start investing in more ads (or SEO) to bring in new, unique customers.

- Upsell to existing customers to increase their spend.

- Create more products to reach more target markets.

Those three options are the main, most common functions of scaling a business.

In its most fundamental nature, growing a business means you are either increasing the value of existing clients or growing your total client base (or both).

But none of those three options and the strategies they require are easy, cheap, or even free.

Not by a long shot.

Time is money.

Even if you are bootstrapping your company without any help from outside agencies, your time is money.

Think email marketing is free? Think again:

- Time (labor).

- Tools (overhead).

- Content creation.

Nothing you do is free.

And all of those different actions or tools factor into your acquisition costs.

For example, looking at the average costs for keywords in your industry on AdWords will inform part of your acquisition spending.

Or, look at how many hours you’ll have to spend writing to create content for your SEO keywords to drive traffic. How much your total labor costs will be?

Each of these acquisition factors works to keep piling on dollars and cents into how much it costs to land a single client.

But what good is CPA without LTV?

It’s simply not.

In other words, what is a reasonable cost per acquisition? Is it industry-based? Are there industry benchmarks to analyze? What seems reasonable?

None of that works.

Here’s why:

Every single business is fundamentally different. Even if you sell the exact same products or services, your:

- Business model is different.

- Clients are different.

- Strategies are different.

Meaning no two acquisition costs and lifetime values will be identical in nature.

And simply benchmarking your CPA to standards doesn’t mean anything.

The simple truth is:

How can you know what to spend on acquisition if you don’t know your lifetime value?

The answer? You can’t.

Lifetime value is king because selling to existing customers is 5x cheaper.

You already have customers. So why are you spending tons and tons of money on acquisition?

Why are you firing up new inbound campaigns and pumping egregious amounts of cash into lead magnets and long-form landing pages with custom designs?

Why are you igniting 10 new PPC campaigns targeting competitive, expensive industry keywords?

Instead, you should first focus on selling to your existing customers.

Why? Because the more existing customers that come back and purchase again, the more money your average customer brings in.

And you don’t have to worry about spending thousands on campaigns.

Do a simple equation right now:

Take all of your existing customers and your total yearly revenue from them. Add them up and divide by the total to find your average.

That number is the average amount that a single customer spends with you in a year.

While not a foolproof way to calculate LTV, it’s an easy estimate to give you a generalized idea.

Now ask yourself:

Is it high enough? Can it be higher?

I bet you could fire up an email pitching new ideas to your existing clients and sell them for an extra $300 each month. In seconds. For just pennies to the dollar in terms of labor and tools.

With a simple new pitch of ideas, you’ve now raised their LTV.

Here’s why that’s important.

LTV Informs Your Acquisition Costs

Now that you have raised your average customers lifetime value, you can spend more on the acquisition.

Higher LTVs = more room for acquisition because you know your average client will spend more than the cost of acquiring them, allowing you to make fancier, bolder pitches to keep clients flooding in.

Instead of focusing so much on keyword costs and content creation costs or how much a link costs you, you can focus on building a better acquisition strategy.

You aren’t confined to such a small budget.

LTV informs your CPA. Without knowing your customer LTV, you can’t know what a reasonable CPA is. It’s all relative to your customer spend.

For instance, if your LTV is $120,000, spending $3,000 on acquisition is child’s play. It’s couch cushion money.

But if you don’t know your lifetime values, suddenly $3,000 doesn’t seem so friendly to your budget and bottom line.

And the problem is that CPA doesn’t necessarily inform LTV.

For example, just because you spent $500 to acquire client X, that doesn’t mean that client X automatically has a high LTV.

Outspending your LTV is a recipe for bankruptcy.

But if your average clients have a high lifetime value, you can now spend much more on acquisition.

That leaves room to try bigger and better tactics like direct mail and account-based marketing where you can spend more money on targeted, high-value campaigns.

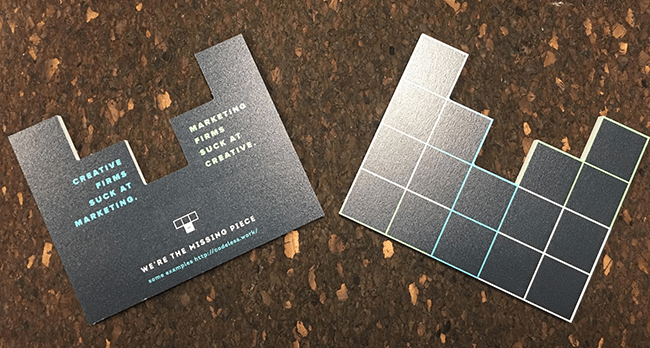

For example, years ago when my agency was focused on web design and development, we took an account-based marketing approach to land high-value clients.

Our LTVs were generally very high, allowing us to spend more money on elaborate acquisition campaigns to continually repeat the cycle of landing big sales.

Using direct mail and some cheesy creativity, we created Tetris-style direct mail content to drive brand awareness and interest.

Once target accounts visited their individual landing pages, they could see customized value propositions for each of them, ensuring real personalization.

We used the same strategy for a warehousing client, providing direct mail pieces that tapped into common pain points for their clients:

Using a dedicated, non-indexed, one-page site, we drove tons of traffic from high-value target accounts.

And this was just the start. Direct mail was just to get their attention in ways that cold emails and traditional mass-produced inbound tactics couldn’t.

From there, the options were almost limitless due to the average spend of customers.

The fact of the matter is that if you can build up your customer lifetime value, you start to open doors for acquisition.

You don’t have to rely on the same old PPC ads and SEO optimization to land clients. You know – the ones that rely on the spray and pray method.

You can get creative and use direct mail or more expensive tactics that are otherwise seen as off-limits.

Here’s how to start leveraging both of these KPIs to scale your business.

How to Use LTV & CPA to Your Advantage

Using LTV and CPA to your advantage requires a focus on lifetime value as your guiding KPI.

Using it, you can drum up ways to start selling more to existing prospects.

You might focus on creating email campaigns, remarketing one-time buyers who didn’t come back or finding cheap ways that you can quickly drive sales.

Start investing heavily in your current customers. You already have them. Start pampering them. Give them upgrades and reasons to stay.

Genuinely invest yourself in their success, and you’ll see their average spend with you skyrocket.

For example, companies like Slack use this strategy by only charging you more for their service as your team grows:

As your team grows and you start to hire more people, you pay for another user.

Meaning Slack doesn’t just upcharge you to stay on their service. They deeply invest themselves in your business growth and success, only charging you more as you need more services to sustain your company.

This type of usage-based pricing is one of the easiest ways to scale existing client growth.

Are you currently charging a flat rate for customers?

Take a look at your existing clients and see what their usage is compared to your normal plans.

See if you can create new plans that increase in cost as your clients grow their businesses and therefore require more services from you.

It’s a mutually beneficial system that helps both you and your client grow.

Analyze your current clients and conduct a site audit to see if there’s anything that they could benefit from that you currently aren’t providing them.

With tools like BuiltWith, you can see what technology they use on-site, giving you insights into potential gaps where you can pitch extra services:

Look for real ways to upsell customers that aren’t just upsells to make money.

Ways that you can help them grow and continue to stick with your business for years to come.

That’s how you create high lifetime value customers.

And high lifetime value customers allow you to reinvest money back into acquisition to keep the funnel moving.

Conclusion

When scaling a business through PPC and SEO, you should have two primary concerns:

Lifetime values and acquisition costs.

Focusing first on lifetime value will allow you to spend more on acquisition, creating better campaigns and a cyclical process of acquiring better clients than you ever dreamed of.

Selling to existing customers will unlock the doors to acquiring more customers.

More Marketing Analytics Resources:

Image Credits

Featured Image: mediamodifier/Pixabay.com

Screenshots by Brad Smith. Taken March 2018.

Subscribe to SEJ

Get our daily newsletter from SEJ’s Founder Loren Baker about the latest news in the industry!