“Introduction of government policies (ELV and EEV) coupled with growing customer confidence and user convenience has driven the Malaysia Used Vehicle Market”

Increasing Number of Inspection Checks: The growing number of inspection checks performed by a dealer before keeping a used car in stock has built the customer confidence with respect to the used vehicle they are looking forward purchase. The dealership outlets have started focusing on providing inspection reports at a price which is affordable by the buyer. Valuation services for used car have helped the seller in computing the resale price at which a used vehicle can be sold to the right buyer and at the right price. It has also helped the seller in deciding upon the negotiation margin in the valuation price of the vehicle.

Increasing Replacement Rate: The replacement rate of used vehicle in Malaysia is growing over the years largely due to the high resale value a seller gets on replacing a vehicle between 3-5 years of vehicle age. The dealership outlets keep replacing the cars with the fast moving models so as to ensure higher margins on the sale of such vehicles. The replacement rate is also increasing (higher replacement frequency) with respect to the government initiatives that are promoting to dispose of a vehicle before a certain specified age.

Strong Presence of Online Platforms: The online platforms has provided high user convenience to the buyers who are looking forward to purchase a vehicle as it provides the detailed description of all the listed used vehicles. The detailed description of a used vehicle has helped the buyer to make a cross comparison of the vehicle on the basis of factors such as model, price, mileage, body type and brand.

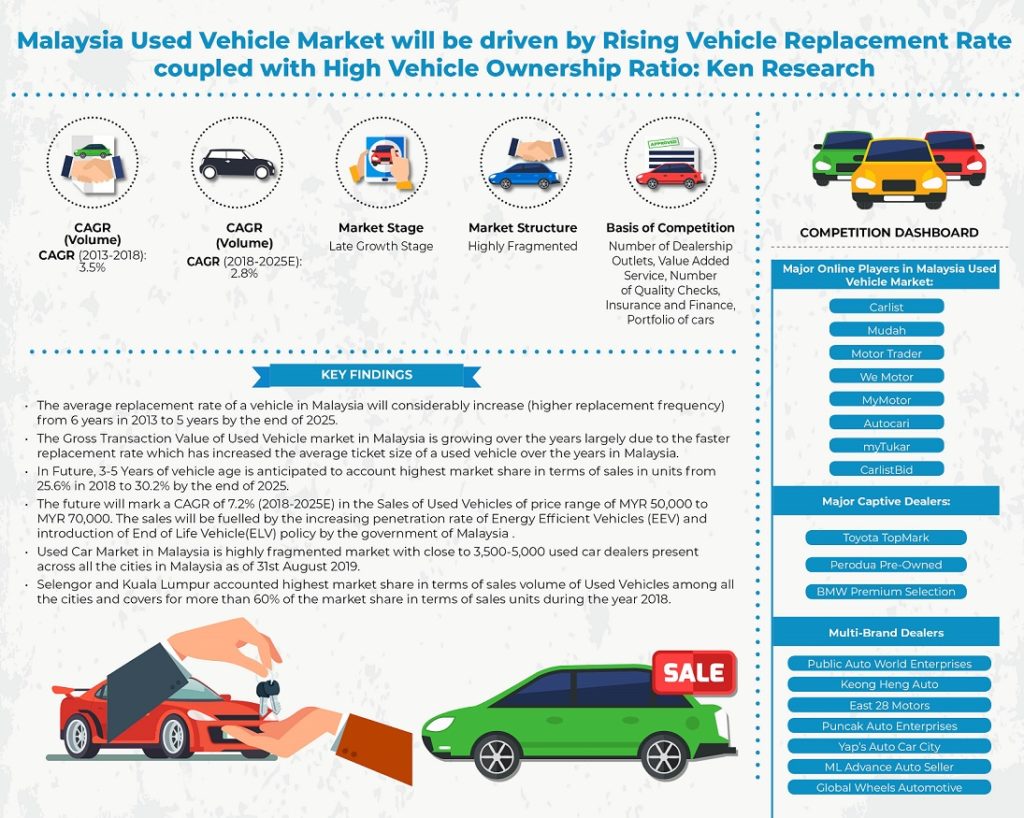

The report Titled “Malaysia Used Vehicle Market Outlook to 2025 – By Type of Distribution Channel (Organized and Unorganized Dealers), By Mode of Selling (Online and Dealership Walk-Ins), By Type of Vehicle (Sedans, Hatchback, SUVs, MPVs, LCV and others), By Vehicle Age(0-3 years, 3-5 Years, 5-8 Years and More than 8 years), By Brand(Perodua, Toyota, Honda, Proton, Nissan and Others)” by Ken Research suggested that the Malaysia Used Vehicle Market has been increasing due to increasing urban population and high car ownership ratio coupled with faster car replacement period and introduction of government policies such as EEV and ELV. The market is expected to register a positive CAGR of 2.8% in terms of sales volume during the forecast period 2018-2025E.

Key Segments Covered:-

By Distribution Channel

Organized Dealers

Multi Brand Retailers

Direct Dealership Sales Agent

Unorganized Dealers

By Mode of Selling

Online

Dealership Walk-Ins

By Type of Vehicle

Sedans

Hatchback

4WD/SUVs

MPVs

LCV

Others

By Vehicle Age

0 – 3 Years

3 – 5 Years

5 – 8 Years

More than 8 Years

By City

Kuala Lumpur

Selengor

Johor

Perak

Others

By Price Range

MYR 0 – MYR 30,000

MYR 30,000 – MYR 50,000

MYR 50,000 – MYR 70,000

MYR 70,000 – MYR 90,000

More than MYR 90,000

By Brand

Perodua

Toyota

Honda

Proton

Nissan

Others

Key Target Audience

OEM’S Companies

Multi Brand Dealers

Captive Dealers

Venture Capitalist Firms

Government/ Regulatory Authorities

Online Auto-Classifieds

Time Period Captured in the Report:-

Historical Period: 2013-2018

Forecast Period: 2019E-2025E

Companies Covered:

Major Online Players in Malaysia

Carlist

Mudah

Motor Trader

We Motor

MyMotor

Autocari

myTukar

CarlistBid

Major Captive Dealers:

Toyota TopMark

Perodua Pre-Owned

BMW Premium Selection

Multi-Brand Dealers

Public Auto World Enterprises

Keong Heng Auto

East 28 Motors

Puncak Auto Enterprises

Yap’s Auto Car City

ML Advance Auto Seller

Global Wheels Automotive

Key Topics Covered in the Report:-

Malaysia Used Vehicle Market Introduction (Overview, Genesis, Business Cycle)

Malaysia Used Vehicle Market Ecosystem

Malaysia Used Vehicle Market Business Model

Used Vehicle Market Size Malaysia

Malaysia Used Vehicle Auto Finance

Malaysia Used Vehicle Market Segmentation

Trends and Developments in Malaysia Used Vehicle Market

Issues and Challenges in Malaysia Used Vehicle Market

Malaysia Used Vehicle Market Regulations

SWOT Analysis Malaysia Used Vehicle

Buying Decision Parameters in Malaysia Used Vehicle Market

Malaysia Used Vehicle Market Competition Scenario

Malaysia Used Vehicle Market Future Projection, 2018-2025E

Future Outlook of Malaysia Used Vehicle Market Segmentations, 2018-2025E

Analyst Recommendations

For More Information on The Research Report, refer to below link:-

Malaysia Used Vehicle Market

Related Reports by Ken Research:-

China Used Vehicle Market Outlook to 2022 – by Type of Vehicle (Sedans, SUVs, Micro Vans, MPVs, Trucks, Buses, Cross Type Vehicles, Trailers, Motor Cycles and Low Speed Trucks), by Vehicle Age, by Distribution Channels, by Region, by Price of Vehicle

Indonesia Used Car Market Outlook to 2023 – Rising Popularity of Online Platforms and Reduction in Average Ownership Period to Drive Used Car Sales

UAE Used Car and Auto Classified Market Outlook to 2022 – By Revenue Streams (Commission, Paid Listings, Banner Advertisement), By Export and Domestic Sales

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249

Tags: Business Model Toyota TopMark, Car Replacement Rate Malaysia, Carlist Business Model Malaysia, Dealers Commission Margin Malaysia Used Vehicle, ELV Policy Malaysia, Major Players Malaysia Used Vehicle Market, Malaysia Car Ownership, Malaysia Online Auto-Classified Business Model, Malaysia Pre Owned Vehicle Market, Malaysia Second Hand Vehicle Market, Malaysia Used Car Registration Process, Malaysia Used Vehicle Average Price, Malaysia Used Vehicle Industry, Malaysia Used Vehicle Industry Research Report, Malaysia Used Vehicle Market, Malaysia Used Vehicle Market Forecast, Malaysia Used Vehicle Market Issues and Challenges, Malaysia Used Vehicle Market Opportunities, Malaysia Used Vehicle Market Outlook Future Outlook, Malaysia Used Vehicle Market Research Report, Malaysia Used Vehicle Market Segmentation, Malaysia Used Vehicle Market Share, Malaysia Used Vehicle Market Stage, Malaysia Used Vehicle Market SWOT, Malaysia Used Vehicle Market Threats, Malaysia Used Vehicle Sales, Malaysia Used Vehicle Trends, Malaysia Used Vehicle Warranty, Perodua Used Car Sales Malaysia, Pre Owned Vehicle Sales Malaysia, Second Hand Vehicle Sales Malaysia, Used Car Sales Toyota Malaysia, Used Cars Sales Kuala Lumpur, Used to New Car Ratio Malaysia, Used Vehicle Captive Dealers Malaysia, Used Vehicle Market, Used Vehicle Market Value Chain Malaysia, Used Vehicle Online Dealers Malaysia, Used Vehicle Sales Malaysia, Used Vehicle Warranty Malaysia