It’s obvious; people who have a positive customer experience will be more likely to spend more with that supplier, pay a premium price for the service, and recommend it to others.

B2B marketing – often seen as B2C’s boring corporate sibling – is starting to prioritize this, building better experiences for its customers.

Why? Because customers are their biggest asset. And on or off the clock, they crave a purchase journey that answers their questions, delivers on promises, and demonstrates a brand’s true value.

Creating an impactful B2B customer journey comes down to knowing who your audience is, mapping out their touchpoints, and delivering the right message at every stage.

From product-led to brand experience

Above all, customer journey mapping is about improving the customer experience.

B2C marketers have focused on creating an unforgettable experience for their audience segments with products that will change their lives for the better.

In contrast, B2B marketers have largely tended to hammer home product features, highlighting ROI and other business advantages to drive purchase intent.

While it’s important for the B2B customer (perhaps a mid-level employee without the power to make the final purchase) to be able to demonstrate a product’s value to internal stakeholders, B2B data sets reveal the wider factors that come into play.

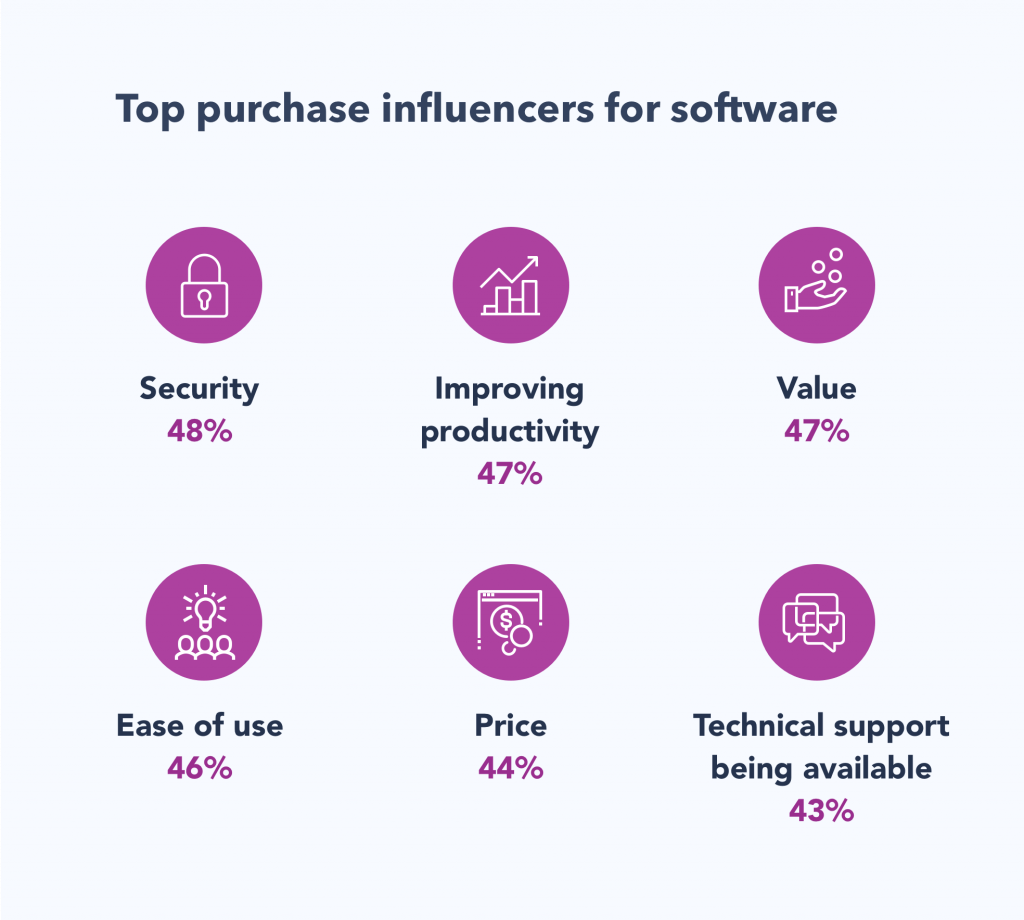

For example, our work data reveals there’s more that drives businesses to purchase than value alone:

This data highlights the need for a more rounded experience –one that taps into the wide range of purchase triggers and pain points, and resonates with the buyer at their individual stage of the journey.

Digging further into data points like this and segmenting by target market, industry and region will pinpoint exactly what your customers are looking for at each stage.

Treat your customer like a friend. Seek to understand, guide and help them.

The next step is building out your customer journey map. The best place to start is with a basic framework.

B2B customer journey map framework

The B2B purchase journey is considered to be comprised of 7 stages, sometimes more or less depending on the product or sector. These can be active or passive on the part of the customer, but each touchpoint is an opportunity for customer contact:

It’s important to note:

The vast majority of the purchase journey (around 80%) takes place without direct support from suppliers. These are known as ‘silent stages’.

In the B2B customer journey, stages 1 to 4 are mostly understood to be ‘silent’; when the buyer seeks out freely accessible, credible advice from owned and earned media to help them make an informed choice.

It’s important you know your audience well enough to deliver the content they need at these stages, as there’s no direct contact.

For the remaining stages, the customer makes themselves known to the supplier.

The rise of sector-specific customer journey mapping

Each industry has different purchasing patterns, and many B2B companies have more than one target sector.

While the framework gives a sense of the path to purchase, really knowing what your consumers want at each stage requires a deep understanding.

For example, project management software may be just as applicable to a large financial services company as it is to small agencies, but the internal structure, demands and purchase journey will be different.

Mapping out the purchase journey by sector will help increase the speed and efficiency of the buying process.

Here’s how this is achieved using B2B data.

Building out a B2B customer journey

As a hypothetical example, let’s focus on one product and sector, mapping the journey using our data.

The percentages below are taken from our survey of 2,127 workers in the financial services sector.

Stage 1: Problem

The professionals in financial services most likely to highlight a business need:

- Senior management (50%)

- Middle management (45%)

- Junior or administration (27%)

Top reasons for purchasing new products or services:

- To improve efficiency / processes in the company (30%)

- Benefits of product / service justify the cost (25%)

- To cut costs in the company (25%)

Stage 2: Awareness

Top awareness drivers:

- Conferences / trade shows / events (34%)

- Recommendations from colleagues / friends / contacts (33%)

- Recommendations from industry analysts (32%)

Attitudes to purchasing new products:

- I prefer to buy from a provider I’ve heard of before but will consider others (40%)

- I will only buy from a provider I’ve heard of before (22%)

- I am open to buying from any provider that meets my needs (14%)

Stage 3: Research

Influential research channels for new products:

- Recommendations from industry analysts (69%)

- User reviews (68%)

- Recommendations from colleagues / friends / contacts (68%)

Purchase influencers financial services employees consider very important (relevant also in the purchase phase):

- Improving productivity / efficiency (45%)

- Security (e. g. that data is protected and encrypted) (45%)

- Value (44%)

Stage 4: Testing

Preferred method of contacting vendors:

- Email the provider (43%)

- Call a sales rep (34%)

- Fill out a buyer/contact form on their website (23%)

Factors encouraging an upgrade to the paid version of a tool:

- Better customer support (32%)

- Increased storage (32%)

- Customized features and functionality (30%)

Stage 5: Pricing and negotiation

Where they typically find the information needed to compare prices:

- Search engines (30%)

- Provider / supplier websites (30%)

- Recommendations from industry analysts (30%)

Stage 6: Stakeholder management

People who have influence in the purchasing of technology, IT, telecoms or software products and services in the financial sector:

- Senior management 91%

- Middle management 51%

- Junior level or administration 23%

Stage 7: Purchase

Departments involved in purchases (remember this may not be the researcher or end user):

- Finance (35%)

- IT / data security (29%)

- C-suite management / leadership team (26%)

Purchase influencers financial services employees consider very important:

- Improving productivity / efficiency (45%)

- Security (e. g. that data is protected and encrypted) (45%)

- Value (44%)

Key takeaway

The perfect B2B customer journey map involves looking deeply into each stage, understanding who you’re talking to, what their motivations are, and how best to reach them.

Once in place, it forms the guiding light for your content marketing strategy, and even informs internal structuring, so you’ve got the teams in place to deliver the right message, at the right time.

While the motivations of the B2B buyer may differ from those of the B2C consumer, they still require a compelling, well-defined customer journey.

What makes the B2B customer journey more nuanced is that the purchaser may not be the problem identifier, or indeed the researcher. All the more reason to be clear on who is at what stage, and what the need is.