With Melio, you can easily centralize upcoming bills and pay vendors for free with a few clicks using a debit card or bank transfers. You can even charge your credit card (for a 2.9% tax deductible fee) to defer payment and extend float while earning card rewards.

Small business owners are all too familiar with how tedious and time-consuming paying business bills can be. Without the accounts payable department found in larger companies, it’s not unusual for small business owners and managers to spend hours every week writing checks and reviewing due dates to make sure they’re in control of their bill payments, and by extension, their cash-flow.

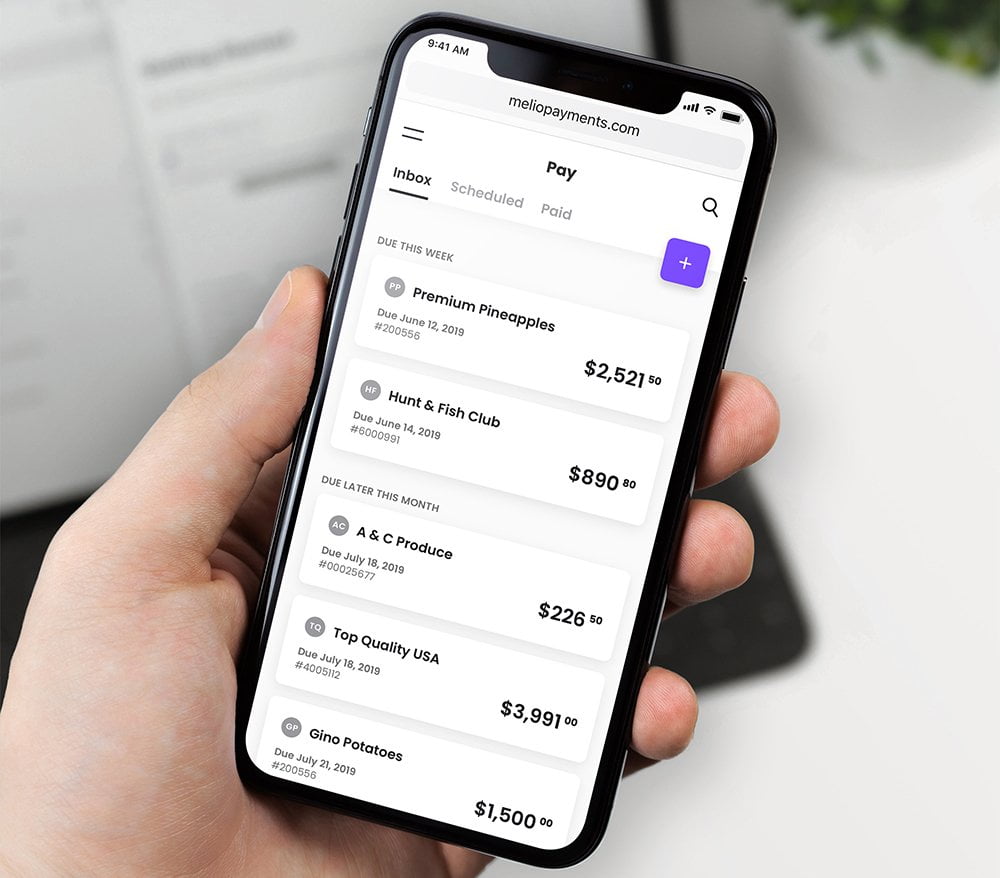

That’s why I’m excited to share Melio, a free and secure online solution that’s completely reinventing payables and receivables for small businesses. With an easy-to-use online dashboard, you can now set and schedule bill-payments as effortlessly as you would pay back a friend for dinner using an app. But with the added security, compliance and features businesses need.

Even ‘Checks-Only’ Vendors

Melio enables quick and easy online payments to all vendors, even the ones that only accept paper checks. That’s because vendors don’t need to register or pay any fees to receive your payment. They just receive a paper check at their address or a bank deposit to their account, depending on the details you enter.

Schedule Payments in Advance

Instead of bulk-paying bills and stressing that they will get there on-time, you can schedule all your upcoming bills so each one arrives just before its due. That way you can make the most of your capital, and don’t have to deduct funds from your account early or incur late fees. Instead of checking your invoices every few days you can just schedule all your payments once or twice a month with a few clicks on your phone or computer.

Not Just for Inventory

Melio can be used for virtually all business bills, whether they’re recurring bills or one-time payments. This includes paying rent, merchandise, utility bills, taxes and pretty much any expense small businesses have. A few shops even use Melio to fund marketing campaigns with a credit card which they repay weeks later, much like a short term interest-free small business loan.

By an ex-PayPal Executive

Co-founded by Matan Bar, who previously led a division at PayPal, Melio takes both security and ease-of-transaction very seriously. When asked why he co-founded Melio, Bar explained that he “wants to provide small businesses with the same convenient processes found in consumer apps and services” and added that “too many small businesses were going out of business simply because of solvable cash-flow constraints”.

Something for Every SMB

Whether you’re looking to centralize your bill-payments, defer payment with your credit card or just save time and money on your bill-payments, Melio is a game-changer. It’s a major upgrade that helps your business minimize hassle and maximize cash-flow.

And with the zero sign up costs or monthly fees, there’s no reason not to try it.

You can learn more about Melio here.

Image: meliopayments.com