Search ad spending growth decelerated across the engines in Q2 2018, digital agency Merkle reported in its Q2 2018 Digital Marketing Report.

Search ad spending growth decelerated across the engines in Q2 2018, digital agency Merkle reported in its Q2 2018 Digital Marketing Report.

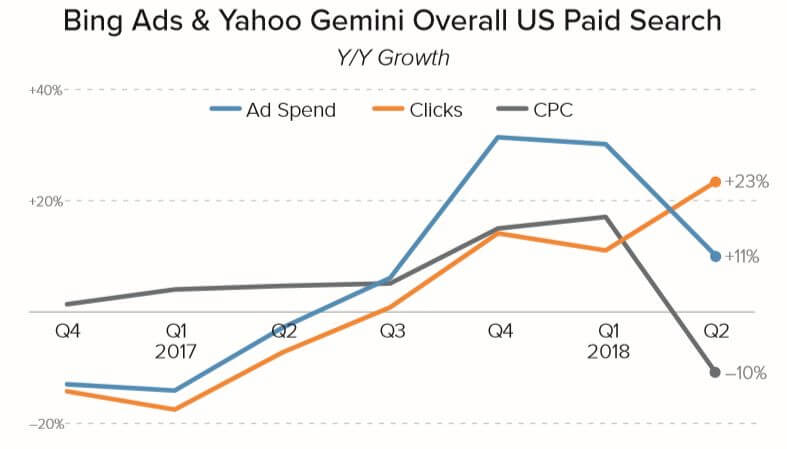

After two strong quarters, the slower growth for Bing and Yahoo in Q2 came from lower CPCs for both Bing Product Ads and text ads. Google search spend growth slowed for the third straight quarter, driven by lower click volume. Google search ad spending grew 18 percent, while Bing and Yahoo search ads spending increased by 11 percent year over year.

Mobile devices (phones and tablets) generated 60 percent of total search ad clicks. Apple’s iOS devices and desktop Safari browser drove 47 percent of Google search ad clicks in Q2.

Google CPCs increasing faster than click volume

Overall, Google ad spend increased by 18 percent year over year, which represents the third straight quarter of slowing growth. CPCs rose 10 percent, outpacing 7 percent growth in clicks. Factors attributing to higher CPCs include higher brand click costs; a higher share of clicks coming from the top two ad positions, which tend to have higher CPCs than those in lower positions; and falling share of clicks from Google Search Partners, which also have lower CPCs.

Phone spending increased by 37 percent. Desktop spending growth slowed to 12 percent, a seven-quarter low.

Merkle says that despite CPCs rising faster than ad click volume — and non-brand text ad minimum bids rising by roughly 20 percent over last year — revenue per click has increased across key segments, due in part to audience targeting capabilities. The agency says 37 percent of Google search ad clicks were impacted by specific audience targeting, including retargeting lists for search ads RLSA, customer match and similar audiences.

Google Shopping continues to grow at a faster pace than text ads. Ad spend on Shopping increased by 31 percent compared to 6 percent on text ads. With the context that Merkle’s clients skew large retailer, Shopping ads accounted for 59 percent of the clients’ Google search ad clicks in Q2.

Showcase Shopping ads drove 4.4 percent of phone clicks among participating retail advertisers, up from 1.6 percent in Q4 2017.

Bing Ads & Yahoo Gemini CPC drop

Merkle continues to report on these platforms together, as Bing still delivers ads on a share of Yahoo search inventory. A sharp drop in CPC growth from 17 percent in Q1 2018 to negative 10 percent in Q2 2018 trended across device types. Brand CPCs, which spiked by more than 40 percent a year ago, grew by just 9 percent year over year in Q2.

Bing Shopping campaigns saw mobile drive click volume growth to 143 percent year over year, yet Shopping spend growth slowed from 64 percent to 40 percent as a result of falling CPCs. Shopping CPCs dropped by 43 percent year over year. Bing Product Ads accounted for 33 percent of Bing paid search clicks.

Amazon ads out-converting Google Shopping by a wide margin

It’s worth mentioning some of the Amazon advertising stats Merkle includes in the report. While traditional search ad spend growth slowed, Amazon Sponsored Products spend grew by 165 percent year over year, and Amazon Headline Search Ads grew 162 percent among Merkle clients. Clicks from both Amazon ad products converted roughly 3.5 times better than Google Shopping ads. Amazon Sponsored Products and Headline Search Ads link to product pages within Amazon.