Shares of Overstock.com Inc. (NASDAQ: OSTK) plunged more than 15% on Wednesday after markets caught wind that CEO Patrick Byrne had sold 500,000 units of company stock. The nature of this large-scale liquidation is unknown, which is making some investors uneasy about the direction of the company.

However, Overstock’s pivot toward blockchain technology and its strong guidance mean that the recent selloff could provide a good buy-on-the-dip opportunity for investors with spare cash.

Q1 2019 Earnings Summary

- Earnings: -$1.18 per share

- Revenue: $367.7 million

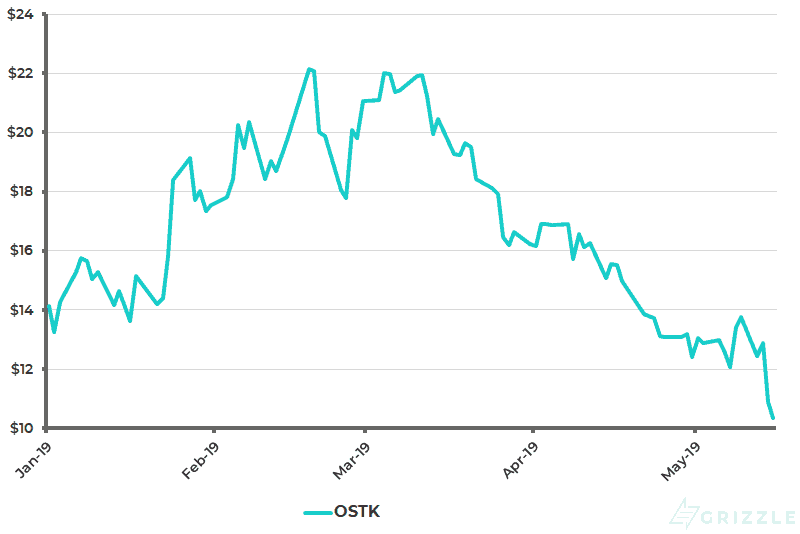

OSTK Sinks to Three-Year Low

Overstock’s share price fell 15.6% on Wednesday, where it closed at $10.87. The stock sold off again after the open on Thursday, losing another 6%. OSTK is currently trading at its lowest level since early 2016 and risks falling further below $10.00, a psychologically significant region.

Source: Yahoo Finance

The selloff was triggered not by fundamentals or even a technical reversal, but by a filing from CEO Patrick Byrne that revealed a major change in his holdings of Overstock shares. As MarketWatch reports, Byrne sold 250,000 OSTK shares on May 13 at a price of $13.33. He liquidated another 250,000 shares later in the day at an average price of $12.84.

The shares are linked to Byrne indirectly through High Plains Investments LLC.

Overstock Provides Strong Guidance

Prior to the selloff, shares of Overstock were riding a bullish wave after the company reported better than expected quarterly revenue and upped its guidance on full-year earnings.

For the most recent quarter, Overstock generated $367.7 million in revenue, down sharply from a year ago but well above forecasts calling for $360.9 million. The company reported a loss of $1.18 per share, which was much smaller than the $1.74 loss in the first quarter of 2018. Analysts expected losses per share to be $0.93.

Nevertheless, the company raised its retail adjusted EBITDA guidance for the year to $15 million from $10 million thanks to an improving retail division. Overstock’s retail business boosted its gross margin guidance to $165 million from $160 million previously. This is partly owed to a 25% reduction in costs.

The quarterly earnings report also revealed seven consecutive months of sequential growth for its search engine optimization (SEO), a core aspect of its business.

Blockchain Transition

Back in November, The Wall Street Journal reported that Byrne is preparing to sell Overstock’s retail arm to focus exclusively on blockchain.

Overstock made its name as one of America’s fastest-growing internet retailers, but is quickly transitioning to become a leading blockchain company. Back in November, The Wall Street Journal reported that Byrne is preparing to sell Overstock’s retail arm to focus exclusively on blockchain.

This might seem like a crazy idea until you realize Overstock’s standing in the blockchain arena. The company founded a project called tZero, an alternative trading system that gives investors access to regulated cryptocurrencies.

Make no mistake: tZero is hemorrhaging money, but remains one of the most highly touted blockchain projects in the world. Case in point: it quickly raised $134 million via initial coin offering (ICO) in 2018. A Chinese company by the name of GSR Capital also led a $270 million investment in the company.

Conclusion

It remains to be seen whether tZero’s blockchain gambit will succeed. Those who are seeking indirect exposure to the volatile crypto and blockchain arenas may want to consider Overstock at these ultra-depressed price levels.

Disclaimer: Author holds no investment position in Overstock.com at the time of writing.