Opening a physical store was an anathema for early-day, pure-play ecommerce merchants. Why take on the financial burden of leases, construction costs, and staff?

But the ecommerce landscape has changed. Brick-and-mortar retailers are now omnichannel. They have endured through a combination of fewer stores and tightly integrated digital offerings, such as buy online and pick-up in store. Many are finding that their physical presence bolsters local online sales.

Why a Physical Store?

Many of the benefits of opening a physical presence are clear. Stores act as billboards in key locations, announcing your brand to scores of shoppers. Stores also provide instant gratification for consumers, which is increasingly important as Amazon trims its free Prime shipping from two days to one.

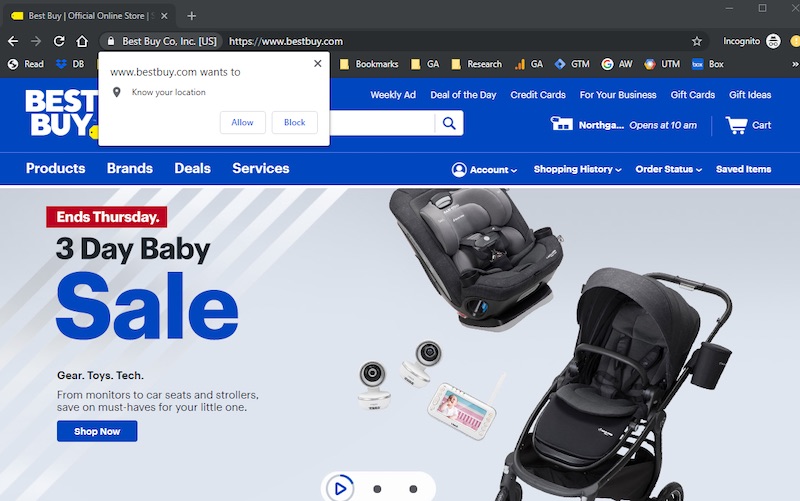

A pivotal part of leveraging newfound physical stores is ensuring they are suitably integrated into your digital experience. The first step is to associate a customer’s physical address with the closest store. Some merchants, such as Best Buy, request the address info openly. Others rely on more passive address detection.

BestBuy.com requests a shopper’s location early on.

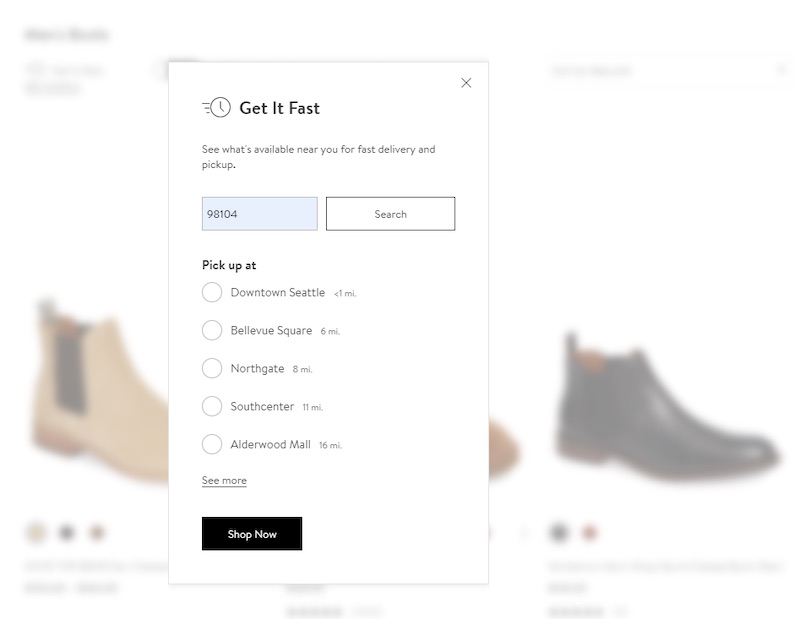

You’ll need to integrate real-time inventory across physical stores and your ecommerce site. This is expensive, typically, but it can be effective in getting customers to your stores, particularly if an item is in short supply.

Few do this better than Nordstrom. Its benefit-focused messaging and easy store selection is seamlessly integrated into the online shopping experience. Importantly, Nordstrom doesn’t wait until the detail page to promote this capability; it’s higher in the funnel, while the shopper is still considering.

Nordstrom.com makes it clear to online shoppers the closest location to pick up their merchandise.

From in-store classes to personal shoppers, a retail store offers brand-building possibilities, as well a laboratory to see what resonates with customers.

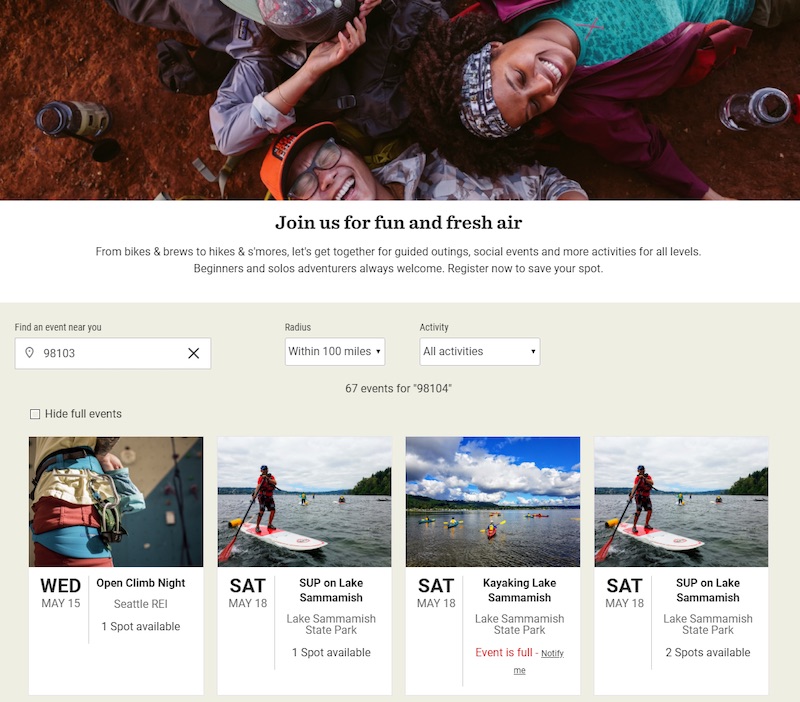

Outdoor retailer REI has turned holiday marketing on its head when it opted to close its physical stores on Black Friday in favor of its #OptOutside campaign. The press coverage was a tremendous boon that also generated sales. After all, if you’re opting to spend time outdoors, you might need new gear.

REI’s in-store experiences are integrated into its digital presence, and, like its store finders, tailored to nearby shoppers.

REI’s in-store experiences are integrated into its digital presence and tailored to nearby shoppers, such as these events for Seattle-area residents.

Physical-store Costs

The pure-plays are seeing the advantages of a discrete set of physical stores. But many overlook the investments that a physical shop requires — digital and on-site. Some of the costs, such as rent and staffing, are obvious. But that’s just scratching the surface.

In addition to design and construction costs, would-be store owners often overlook permitting, mechanical systems, and even real estate taxes. Depending on the lease, you might receive a tenant improvement allowance to ease your build-out costs. Or you might not.

Another expense is in-store tech. How merchants augment their physical experience varies greatly based on merchandise and brand. Spanish apparel retailer ZARA, for example, is making numerous investments in its in-store experience from self-checkout to click-and-collect pop-up stores with smaller footprints and lower rents to match.

Another surprise is frequently the shared costs in a mall or strip center. Common-area-maintenance costs include cleaning of common areas, basic repair, heating and cooling, shared marketing activities, and security.

Rent based on sales volume is typical in high-traffic shopping centers. It’s calculated every month, in my experience, based on the honor system — the tenant discloses sales to the landlord. But some leases include a clause granting the landlord the right to audit a tenant’s books.

Before committing to a location, talk to a leasing agent. Some landlords, to attract high profile tenants, offer up exclusives or non-competes for certain categories. This can be a boon if you land an exclusive agreement to sell your wares in an attractive location, but it also can preclude your presence if someone beat you to the punch.

Experimenting

A physical presence offers many advantages, but it can be expensive. Temporary locations and pop-up shops are less costly options that also help retailers experiment before signing long-term commitments. With cross-channel measurement getting easier, we can expect retailers to continue experimenting — with both clicks and bricks.