The rapid pace of urbanization and industrial advancement has considerably strengthened the growth prospects of the global pumps industry. In essence, this has expanded the popularity of this business space and tagged it as one of the most profitable verticals of the HVAC sphere. Endowed with an enormous application landscape, ranging from the mammoth mining sector to oil & gas facilities and the ever-expanding construction sector to the emerging wastewater treatment equipment market, pumps market has time and again proved its mettle.

Keeping up with the evolving needs of the consumers, renowned global pumps manufacturers have been striving tirelessly to build cost-effective and highly efficient products – a factor that has bolstered the expansion prospects of this industry across various end-user sectors. Well suited for transferring large volumes of low viscosity liquids, pumps are commonly utilized to transfer water, light fuels, sludge, and a range of chemicals.

Conventionally, the classification of pumps has been based on the method they use to move the liquids and the technology involved in the process. Although a wide range of pump technologies have been devised so far for myriad end-uses, the centrifugal pumps have come to the fore as the most preferred pumps across numerous business sectors.

How is the development of highly energy-efficient and innovative centrifugal pumps influencing the overall pumps industry?

Owing to their simple design and minimal maintenance costs, centrifugal pumps have become the most commonly used pumps in the industrial and residential settings alike. Especially, the product enhancement activities being undertaken by global pump manufacturers to rework the design and drastically improve the efficiency of the industrial centrifugal pumps have been instrumental in proliferating the worldwide pumps market size. Enlisted below are two prominent instances that depict the product ingenuity demonstrated by well-known pumps manufacturers:

- Swiss manufacturing firm Sulzer has recently unveiled a new CPE end-suction single-stage centrifugal pumps with revolutionary hydraulics and high efficiency which reduces the risk for unplanned shutdowns. The new industrial centrifugal pumps function on low energy and are designed to exceed the harshest energy regulations for all end-uses. With a consistency up to 6% for fibrous slurries and other viscous liquids, Sulzer’s new pumps have set a new benchmark in terms of efficiency and energy consumption.

- Tapflo – the Swedish manufacturer of air operated diaphragm pump – has recently developed a new plastic version of its CT centrifugal pumps. The mechanically sealed and compact pump has been named CTP Pump and can predominantly be used in surface treatment industry to transfer various chemicals from storage tanks to smaller containers, to pump CIP detergent used for cleaning of pipes, and to transfer, filter, and circulate surface treatment baths.

Having recognized the escalating demand for these pumps worldwide, the global pump manufacturers such as Tapflo and Sulzer appear focused toward creating a new breed of industrial centrifugal pumps that would fit into the requirements of the fast-evolving end-user sectors. This trend of innovation has fortified the position of centrifugal pumps in the technically advanced product segment of the pumps industry.

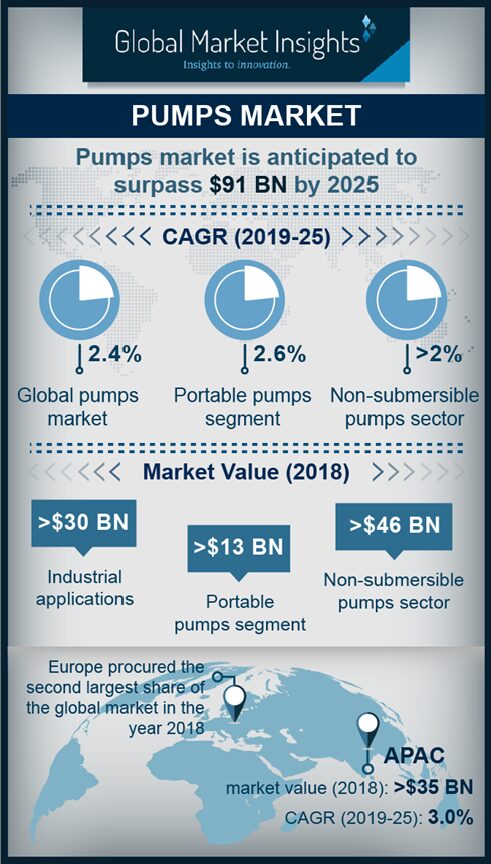

In fact, as per a research report by Global Market Insights, Inc., the worldwide sale of centrifugal pumps was pegged at more than USD 53 billion of the total remuneration portfolio of the pumps market in the year 2018. The centrifugal segment thus dominated the overall pumps industry in 2018 and is expected to show a CAGR of 2% over 2019-2025.

Tracking the correlation between the fast-growing APAC construction sector and escalation in the fortunes of pumps industry

Over the past few years, a significant slowdown in the domestic consumption rates across the major developed economies in the North America and Europe is predominantly accredited to the global economic slump. On the other hand, the emerging nations across the Asia Pacific are demonstrating consistent economic growth which makes it the most dynamic region of the global economy. The estimates published by the International Monetary Fund substantiate the growing dominance Asian economy which is forecast to grow at a commendable annual rate of 5.6 percent in 2019.

Increasing participation of the private sector in the public infrastructural projects, a substantial rise in the government’s budgetary allocations for various construction schemes, and the overwhelming pace of urbanization have been instrumental in stabilizing the economies of APAC region. In this context, it is imperative to take note of the region’s construction sector which has, among all other business sectors, emerged as a crucial vertical in catapulting the Asian economies on the global financial map.

Taking into account the indispensable role of the construction industry in the successful implementation of the developmental schemes, almost all APAC countries are expected to invest substantially in the residential, industrial, and infrastructural projects over the next few years. Apparently, these projects would necessitate the deployment of pumps in large numbers – a factor that will certainly open up new opportunities for the global pump manufacturers in the APAC region. Enumerated below is a brief overview of the construction sector across the prominent Asian economies and its circumstantial impact on the remuneration scope of the pumps market size:

India

Regarded as one of the fastest growing economies of the world, India has been making laudable progress in terms of building public infrastructure which has boosted the prospects of the nation’s construction sector in an unprecedented manner. Unsurprisingly, construction is the second largest economic activity in India after agriculture and is slated to surpass a humongous market share of USD 1 trillion by 2025. Recognizing the need for private sector investment in strengthening public infrastructure and addressing the issues of civic amenities, the Indian government has allowed 100 percent Foreign Direct Investment through automatic route for townships and cities.

Moreover, the launch of ambitious big-ticket infrastructural projects by the government over the past few years has fueled the construction sector, essentially providing a vast business opportunity for the Indian pumps market players. Enlisted below are a few major infrastructural projects and the corresponding massive investment that is being directed toward them:

|

Name of the project

|

Budgetary Allocation

|

|

Delhi Mumbai Industrial Corridor

|

USD 100 Billion

|

|

Bharatmala Project

|

USD 77 Billion

|

|

Smart Cities Mission

|

USD 14 Billion

|

|

Setu Bharatam Project

|

USD 1.5 Billion

|

The aforementioned projects are likely to transform the commercialization prospects of the Indian pumps market as the product demand from the construction sector would experience a sizeable increase in the upcoming years.

Indonesia

Known as the nation of islands, Indonesia aims to develop its marine resources to establish itself as a global maritime hub. To that effect, the Indonesian government has been framing comprehensive policies that would establish a robust infrastructure to attain maritime superiority. These policies have invariably opened up numerous business avenues for the nation’s construction sector as the total spending of public and private players in the infrastructure projects has increased substantially. Launch of various redevelopment projects and the construction of an inter-island marine toll roads, large terminals, and ports, have improved the prospects of the construction sector.

Large-scale infrastructural projects such as the Tarahan Coal Terminal and Kalibaru Port have revitalized many Indonesian infrastructure-related firms and have turned the attention of the global pump manufacturers toward the country. As per some reliable estimates, Indonesia’s construction spending is expected to surpass the figure of USD 165 billion by the year 2025. This is in addition to the capital spending planned by the government over the next few years. Apparently, a qualitative development in Indonesia’s infrastructure projects and the expansion of the construction sector have invariably translated into a substantial increase in the demand for pumps, in essence, proliferating the global pumps market size.

The ongoing trend of energy efficiency, sustainability, and cost-effectiveness has urged the global pump manufacturers to redesign their product strategies and unveil innovative pumps that cater to the evolving needs of the various end-user verticals, essentially favoring the commercialization aspects of pumps industry. Moreover, the swift increase in the product demand from the construction industry across numerous emerging countries in the APAC region is proving to be a crucial factor in establishing pumps industry as one of the most dynamic niche verticals of the HVAC cosmos.

Global Market Insights, Inc. has a report titled, “Pumps Market Size By Type (Portable, Stationary), By Position (Submersible, Non-submersible), By Driving Force (Engine Driven, Electrical Driven), By Technology (Centrifugal Pumps, Diaphragm Pumps), By Application (Mining, Building & Construction, Oil & Gas, Industrial, Municipal), Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Italy, Russia, China, India, Japan, Australia, South Korea, Thailand, Indonesia, Malaysia, Brazil, Mexico, South Africa, Saudi Arabia, UAE), Growth Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2025” available at https://www.gminsights.com/industry-analysis/pumps-market