Ring main unit industry has garnered a significantly high traction over the past few years, primarily on account of the critical need for power supply across the globe. The surging demand for electricity for myriad purposes has necessitated the requirement of highly innovative and efficient electrical components such as transformers, generators, distribution systems, switches, and ring main units. As the demands for electricity continue to surge, power distributors have been facing increasing challenges to provide electricity at reduced costs with exceptional efficiency. The escalating demand requirement to expand product portfolios amidst the robustly fierce competition has led to the innovation of advanced products, thereby contributing substantially toward ring main unit market size. In the year 2014, for instance, ABB Group, a Swedish-Swiss multinational firm based in Switzerland, had developed Safe Link AB, a new outdoor ring main unit fit to be used in urban and rural distribution electric grids. The new product, which was manufactured for 12 kV medium volt secondary distribution network, offers compact, durable, reliable, maintenance-free, and cost-effective benefits to its end-users, thus charting a profitable growth path for ring main unit industry.

Ring Main Unit Market: A succinct introduction

Ring main units are a critical part of secondary distribution systems and offer protection to the distribution transformers against occasional high voltage electric currents. These components play a key role in providing incessant power supply through alternative means in case of technical hitches in the main power supply source. Given the rapidly increasing demands for efficient distribution systems, it comes as no surprise that ring main unit industry is forecast to gain mass popularity in the ensuing years. As on April 2017, around 30 countries across the globe operate more than 449 nuclear reactors for electricity production, with 60 new plants already under construction in 15 countries. In 2016, it was found that around 13 countries were dependent on nuclear energy to supply approximately 25% of their power supply demand. These statistics affirm that uninterrupted power supply is the need of the hour – a factor that is principally driving ring main unit market.

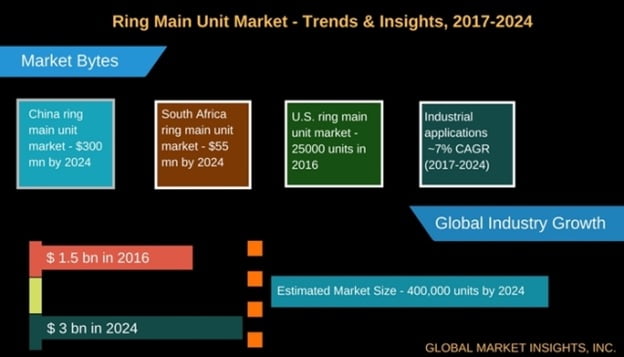

Ring main unit industry encompasses a rather enviable application spectrum – the component is used across underground railways, office buildings, hotels, light mining, tunnels, airports, wind farms, distribution utility networks, residential housing complexes, shopping centers, and hospitals. The product can operate with exceptional efficiency in both indoor and outdoor settings. On these grounds, the fact that ring main unit industry size was valued for more than USD 1.5 billion in 2016 comes forth as an indifferent phenomenon.

Unveiling a product-based outlook of ring main unit industry

Channeled by a plethora of R&D and testing activities, ring main units are available across widespread range, though by virtue of research, gas and oil insulated products have been documented to be two of the important ones. These components have found extensive applications in transformers, pole & structure mounted instruments, and ground mounted devices, all of which are heavily in pursuit across the commercial, utility, and industrial sectors, undeniably expanding the scope of ring main unit industry.

Gas insulated RMUs branded with flexibility, reliability, and operational excellence are available in the various forms such as vacuum circuit breakers and fuse switched ring main units, the escalating demand of which will propel gas-insulated ring main unit market. Oil insulated RMUs, on the other hand, are used extensively across medium voltage switchgear industry. Fuse switch ring main unit, an oil insulated ring main unit type, finds deployment across rural areas and oil fields, even in unfavorable climatic conditions, thus providing a huge range of avenues for oil-insulated ring main unit industry.

A precise archive of product innovations brought forth by ring main unit industry giants:

- Lucy Electric, a prominent player in ring main unit market, encompasses a product portfolio that includes the Scimitar, Aegis Plus, and Aegis 36 – uniquely designed gas insulated RMUs with a humongous application scope inclusive of distribution grid networks, PV power stations, and wind energy mills.

- Schneider Electric, another reputed giant partaking in ring main unit industry share, has brainstormed the RM6, a kind of ring main unit, that can make 2/3/4-directional connections with line protection via circuit breakers, network switching through switch disconnectors, and integrated power supply via electric tele-control instruments. Pertaining to the same, this product has apparently garnered immense popularity across various end-use sectors, thus providing the much-needed boost to ring main unit industry.

- A study published by LS Industrial Systems claims one of their contactors, the Tri-MEC, to have been designed with RMUs, for use across compact substations, power plants, and small firms. The product displays exceptional safety features such as automated interlocking system, safe operability, voltage detecting device for monitoring voltage in cable, and operation status indicators. The surging deployment of such products is certain to augment ring main unit industry growth.

Ring Main Unit Market scope across the Asia Pacific belt

Rural electrification has become a mandate in most Asian nations, given the periodic power failure prevalent across the underdeveloped provinces. In this regard, it is noteworthy to mention that the governments of countries such as India and China have been earnestly striving to promote electrification across rural areas. In fact, many electrification projects across underdeveloped landscapes have been monetarily supported by financial institutions such as the World Bank, Asian Development Bank, and the International Finance Corporation.

An insight into China ring main unit industry: The Past and the Present

Toward the end of the 20th century, around 40% of the rural localities in China reportedly had no access to power – seemingly, the population of these regions depended on kerosene lamps for light. Besides, the scope of electricity usage for myriad other tasks was seemingly nil, which reduced the possibilities of grid expansions in the region. Given the grim situation, it was not incorrect for experts back then to claim that the inception of ring main unit market in the region was practically oblivion.

At the beginning of 21st century however, the Chinese government undertook strenuous efforts to resolve the problem of electricity supply shortage in the rural areas through the launch of projects such as the China Township Electrification Program. Reportedly, it was one of the biggest global ventures launched in 2001 with the objective of addressing the power supply concerns of the rural population of the country through renewable power supply to nearly 1000 towns in China. The project was a milestone for the gradual growth of ring main unit industry in the region.

The contribution of the Chinese government toward the development of the ring main unit industry in the area is indeed commendable. In 2010, the country again introduced the China Village Electrification Project with a goal of providing power to over 3 million homes across nearly 10,000 provinces. As recent as 2015, the Chinese government spent nearly USD 340 million for the electrification of the remaining 39,800 provinces and hired more than 5000 workers to connect two distant regions in the Qinghai province via electric grid network. These electrification programs necessitate the deployment of ring main units on a large-scale, which will consequently provide a boost to the regional ring main unit market size over the years to come.

An insight into India ring main unit market: The Past and the Future

Analogous to its developing counterpart, the country of India has also been facing electricity supply shortages across rural areas, which in fact, to date, is a major problem obstructing the industrial progress of the nation. The necessity of electric grid installations across the underdeveloped provinces assumed the form of the Rural Electrification Corporation (REC) Ltd. in 1969, when the Indian government planned to address and resolve the power supply problems of the villages in the country. Unbeknownst to experts back then, this move played a major role in the subsequent expansion of ring main unit industry in the country.

As per reliable data, in 2012, nearly 304 million of the Indian population did not have access to electricity. However, REC reports claim the electrification of nearly 99% of 597,464 villages in India in Q2 2017. The government has been promoting an increasing number of wind, biogas, and solar energy programs to solve the problems of rural power supply shortage in addition to encouraging the adoption of renewable energy. The rising number of power plants demand the installation of numerous ring main units, inherently augmenting the regional ring main unit industry. The Indian government has also been launching programs such Pradhan Mantri Gram Vidyut Yojana and JNN solar venture for rural electrification, thereby providing an impetus for ring main unit market expansion.

Recently in the South Indian suburbs, the Kerala State Electricity Board’s (KSEB) ring main unit project, which aims at automating the power distribution network in Kochi and the neighboring areas, was successfully commissioned. The move is likely to bring about a substantial impact on ring main unit industry. Implemented under the Restructured Accelerated Power Development and Reforms Program (R-APDRP), the project was launched somewhere in 2000, however, it was halted midway due to technical issues. Now in 2017, seven years post its inception, the project has been successfully completed and is slated to positively ensure minimal power supply disruption, thereby drawing a positive path of progression for ring main unit market.

The first phase of the project alone encompassed the replacement of 11 KV lines with underground cables and the installation of ring main units. In fact, about 900 RMUs have already been installed. In the event that this initiative acts as a paragon of efficiency, other governmental electrical networks are likely to follow suit, which will eventually lead to the augmentation of ring main unit industry in India.

Major ring main unit market players such as Schneider Electric, Lucy Electric, Alstom, Ormazábal, and Larsen & Turbo have been investing heavily in rural electrification and renewable energy projects as a part of their corporate social responsibility. These firms have also been supporting the regional governments to tackle the issue of power supply shortage by means of innovative product development. Furthermore, it is noteworthy to mention that the rising number of research activities to develop highly efficient products will contribute appreciably toward ring main unit industry growth. A recently compiled market research report in fact, claims global ring main unit market to hit a revenue of over USD 3 billion by 2024, pertaining to the worldwide requirement for continuous, uninterrupted electricity supply on account of the exorbitant power consumption across the globe.

Global Market Insights, Inc. has a report titled “Ring Main Unit Market Size By Insulation (Gas, Air, Oil, Solid di-electric), By Position (3-position, 6-position, 10-position), By Installation (Indoor, Outdoor), By Component (Switch & fuses, Self-powered electronic relays), By Application (Distribution utilities, Industries, Infrastructure, Transportation), Industry Analysis Report, Regional Outlook (U.S., Canada, Mexico, UK, Germany, Russia, Italy, Spain, France, China, India, Japan, South Korea, Australia, Malaysia, Saudi Arabia, UAE, Kuwait, Qatar, South Africa, Nigeria, Brazil, Chile, Venezuela), Price Trends, Competitive Market Share & Forecast, 2017 – 2024” https://www.gminsights.com/industry-analysis/ring-main-unit-market