Getting insight into which touchpoints drive the best ROI for your brand

To maximize their performance in today’s competitive retail landscape, brands need a single, accurate view of the market with instant insight into consumer purchase behavior. In my second post in this blog series, I’ll look at how the GfK Consumer Journey solution delivers that and enables brands to understand how consumers do their research when they buy a new product.

My previous post looked at the purchase triggers in the UK television sector as an example of the insights brands can get from the GfK Consumer Journey module of the Consumer Insights Engine. This time, I’ll look at how the solution can give brands accurate, actionable information about how and where consumers research and evaluate their options when they are looking to purchase a new TV.

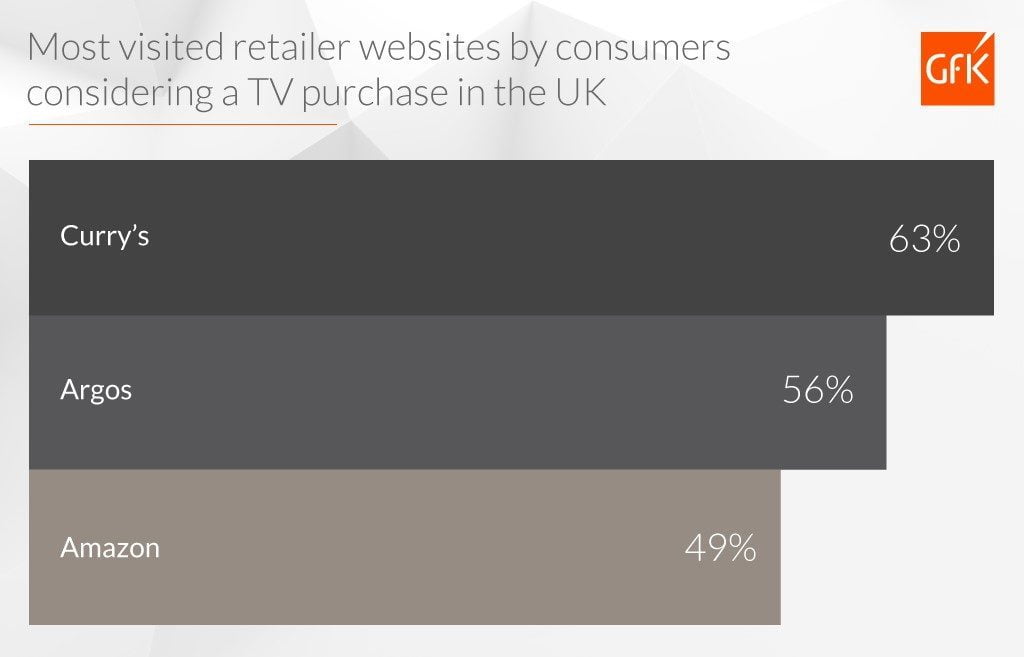

Our Consumer Journey survey data reveals that the majority of television buyers in the UK do their research online. Most of them visited major retailer websites during their purchase journey – the most popular among TV purchasers were Curry’s (63%), Argos (56%) and Amazon (49%).

(Source: Consumer Insights Engine Consumer Journey, Q1 2018 data for UK TV market)

Perhaps that’s not so surprising, but our numbers also show that in-store touchpoints still play a major role in the purchase journey. More than half of TV purchasers visited a physical store to research their new TV. Of those who researched their options online, 57% made their purchase in-store.

What’s more, in-store visits have higher conversion rates than online channels. Around 82% of people who went to a store bought a television in-store, while only 42% of those who searched online made a purchase online.

(Source: Consumer Insights Engine Consumer Journey, Q1 2018 data for UK TV market)

(Source: Consumer Insights Engine Consumer Journey, Q1 2018 data for UK TV market)

Even in a digital age, in-store advertising and displays play a major role in driving sales, but as our consumer journey insights research shows, this does differ somewhat by brand.

This sort of insight is invaluable to marketing teams in optimizing their online and offline marketing and advertising channel and touchpoint investments throughout the consumer journey. They will know which channels and brand/product touchpoints consumers use during their search and evaluation of new products, helping them to make better decisions about campaign execution.

They can also see which consumers considered their brand but bought something else, and why they made that choice. We will look into why consumers in this market purchase products in my next blog post. These insights enable brands to plan ahead and improve conversion rates amongst lost shoppers. Product category managers and operations departments, meanwhile, can learn about where consumers are researching and buying product, so they can make better stocking decisions.

In the new year, we introduce online passive behavioral data to the Consumer Journey module. The introduction of this data will allow visibility of device use, search terms, touchpoints, sites visited and more. This will provide brands an even more granular view of consumer’s online behavior during the purchase cycle.

One way in which GfK Consumer Insights Engine is unique is that it provides all of these insights in a single platform. This eliminates the need for multiple data and insights suppliers and provides a coherent view of your consumer’s purchase journey. I encourage you to try our online Consumer Insights Engine demo to understand how it works in practice and how it could help you make smart, rapid decisions.

Discover more consumer journey insights from the rest of our ‘Beyond Point of Sales Data’ blog series:

Beyond Point of Sale Data: Which consumer needs trigger the start of the purchase cycle?

Go Beyond Point of Sale Data: Understand the Moment of Purchase

Beyond Point of Sale Data: The importance of understanding early usage in the consumer journey