Google’s continued dominance as a search giant was evident in its third quarter earnings call, as it grew advertising revenue 18% year over year to $19.8 billion (Alphabet, as a total company, wasn’t too bad either, up 20% in total). Total paid clicks grew 33% year over year, while the cost per click dropped 11%.

So, what does this all mean? Simply put, Google is still a dominating force for both consumers, and therefore advertisers. This is an undeniable fact, but what is up for debate is how consumers and brands interact with the results Google returns to consumers.

Paid and organic increase

There have been significant updates over time in an effort to keep up with changing consumer and advertiser demands. This year so far, voice search, local listings, and mobile indexing have been big topics.

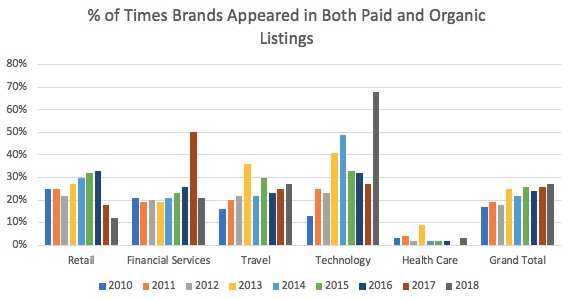

In an effort to monitor these changes, I have been tracking the search results activity for a number of brands over the past 9 years. I took 50 terms across five verticals to see how many times the same brand appears in paid and organic listings. The findings this year are very interesting.

Overall, it is clear that between Google’s changes (both algorithmically and an increasing number of paid listings), as well as each brand’s growing focus on search engine marketing, the amount of companies that appeared in both paid and organic listings reached its highest point in 9 years at 27%.

This was driven by the offset in categories going in two separate directions. Retail has gone down the last two consecutive years; I believe this is owing to an increase in Google shopping results, non-branded paid search, ROI challenges, retailers’ experiences, and of course, Amazon.

While retail is at a low, travel has increased consistently over time. I believe this category is growing as a result of direct booking on travel sites that comes with price guarantees.

The tech category also saw a spike. A big contributor to this trend is the branding that is occurring in the industry. Consumers aren’t just searching for smart speakers, they are specifically searching for Alexa and Google Home, for example.

These companies have done a good job circumventing shopping at the category level, and have jumped directly to branded terms. We’ve never seen a category have greater than 50% overlap of paid and organic brands listed. Given this trend, this year technology spiked to 68%.

Appearance in search results

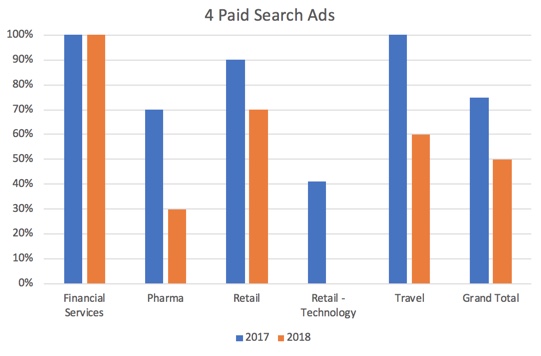

In addition to brands balancing their paid and organic results, I also wanted to start watching how often four paid search ads, shopping listings and local listings appear in search results. Google has been offering these different ‘sections’ of the search results page in an effort to answer a consumer’s query with the information they might be looking for.

I’ve identified two major takeaways from this. First is the decrease of listings with four paid search ads. Year-over-year, every category is down, with the exception of the financial services industry, which makes sense given the competitive nature of this category and the high value of the products. These keywords have the highest CPCs of any category. So naturally, brands are willing to pay and Google is willing to take their money.

Shopping ads are fairly flat across these categories. They are prevalent for verticals where products can be purchased, and are not displayed in the other categories. Shopping is incredibly important for the retail vertical and I expect this trend to stay the same as the retail war with Amazon and consumers wages on.

The second trend is one that is not a surprise for BrandMuscle given our focus on local, but might be for many who are catching on to the importance of local in the mobile world. Local listings are now shown across all verticals and growing in key sectors like retail. This is extremely important to pay attention to for two reasons:

- As consumers shift to mobile, they expect their devices to know where they are and show relevant local listings

- These listings offer the opportunity for brands to see free traffic.

What can brands take from this?

So what are the key items brands need to think about with these trends?

Local listings are growing and demand attention. Do some searches for your category terms. Are local listings being shown? If so, are you included in those listings? These are ranked in two ways:

- The distance of the location to the searcher

- The validity of data across platforms – this is the one you can control.

Are your locations name, address, and phone number accurate across Google, Facebook, Yelp, and others? You’d be surprised how often these are incorrect. Spend some time focusing on cleaning up this data and monitor your results – I think you’ll be pleasantly surprised.

It’s important to consider your integrated strategy for both paid and organic search. Brands are owning more and more of the search real estate. It is vital that you have a strategy that does not give up ground to these brands, but focuses on your core strengths and differentiators. For example, perhaps you can’t afford to buy the keyword ‘car insurance’, but you can own ‘SR-22 insurance’ as a term, given your company’s key strengths.

Keep a close eye on Google’s changes. Google has been very active in staying ahead of consumer expectations and technology. This includes switching to mobile indexing and launching new tools for Google My Business, among other items. This requires focus and planning for businesses to adopt these changes and stay best-in-class.

Search is one of the most important tools in a marketer’s toolbox. These trends and feature changes make it an exciting place to work and spend time. I look forward to watching how brands react to these trends and monitoring more changes in the future.