Keyword research, the foundation of search engine optimization, also drives content strategy.

Searchers want something: information or a product. When we research keyword data, we mine the search engines for information on the words and phrases searchers use to find the things they desire.

Featuring content for products in the way that consumers naturally think and speak about them will drive more shoppers to your site via natural search. It will also help those shoppers on your site find what they’re looking for more quickly, to purchase.

Digital marketing can be maddeningly subjective. There are a lot of opinions and areas of expertise, but few large-scale quantitative data sets available on which to base decisions. Keyword research provides a refreshingly quantitative approach to digital marketing, and content strategy specifically. Where else can you get quantitative data from millions of potential customers on what they most want in their own words, at no cost?

Featuring content for products in the way that consumers naturally think and speak about them will drive more shoppers to your site…

What Is Keyword Data?

In its simplest form, keyword data is just a word or phrase, such as “drill,” with the number of searches conducted for that keyword and similar keywords in an average month.

The example below uses data from Google Keyword Planner. The keyword “drill” drives approximately 60,500 U.S. searches in an average month, in Google. The other columns show the number of searches in each month to enable seasonality tracking; a competition score (the competition for drills is high and more difficult to rank for); and suggested bid (buying “drill” in paid search would cost $.47 on average).

Keyword data on drills from Google Keyword Planner.

The 60,500 searches shown for “drill” probably encompasses not only “drill,” but also similar keywords such as “drills” and misspellings such as “drils.” Google Keyword Planner aggregates these very similar keywords into a single keyword theme represented by the keyword it actually displays — “drill” — in the data.

While keyword data is powerful, there are a few limitations. The data only shows search terms, not who the searchers are. There is no demographic information, beyond what can be gleaned from the keywords themselves.

For instance, someone searching for “professional drill” might be a contractor. Or she might just want a strong drill that won’t easily break. We have no way of knowing.

As often as possible, use multiple data sets from different keyword tools to corroborate your content strategy.

Content Strategy

After collecting the data, look for common themes within the keywords and phrases.

The themes that show strongly in the keyword data are also the types of content that searchers desire. And because the data contains the average number of searches, there’s a built-in way to determine which types of data will be the most valuable to target.

In the sample set of data for “drills,” we can see that many people search for types of drills, with hammer drills being the most popular. Rotary drills and other types appear later in the data, but hammer drills drive the largest volume of searches.

In this tiny sample, hammer drills drive over 100,000 searches a month — that’s 28 percent of all of the searches for drills in this dataset. In a deeper set of keyword research, it would probably balance out a bit more, but in our small sample it’s a good spot to target for content.

Brands are also a driving factor in the keyword data. Makita, DeWalt, Milwaukee, Bosch, and Ryobi all factor into the top 25 keywords shown above.

Other searchers are looking for the type of power that a drill might use. Cordless and electric are the most common, but battery-powered and corded show up later in the data.

For each of these three areas — types, brands, power sources — we’ll want to look at the type of content that will satisfy each theme in our keyword research. On an ecommerce site, that content strategy will first and foremost be satisfied by the taxonomy of products offered.

Types of drills, brands, and power sources are all product attributes; they describe features of a product that shoppers want to buy. They indicate purchase intent versus informational intent.

Therefore, to satisfy the desire for those products, the site should offer categories or filtering functions for each of these attributes. The largest area of demand — drill type — would be the category level. Brand and power source (as well as color and a few others that show up later in the data), would be better served as filters on the categories’ product grid pages.

Any one of these areas could also drive article topics to target searches with informational intent. This type of content usually takes the form of FAQs, how-to guides, glossaries, and the like. To determine which is more likely to target informational intent, we need to research more deeply. Since “hammer drills” are the most searched for grouping in the data, we’ll use that as an example.

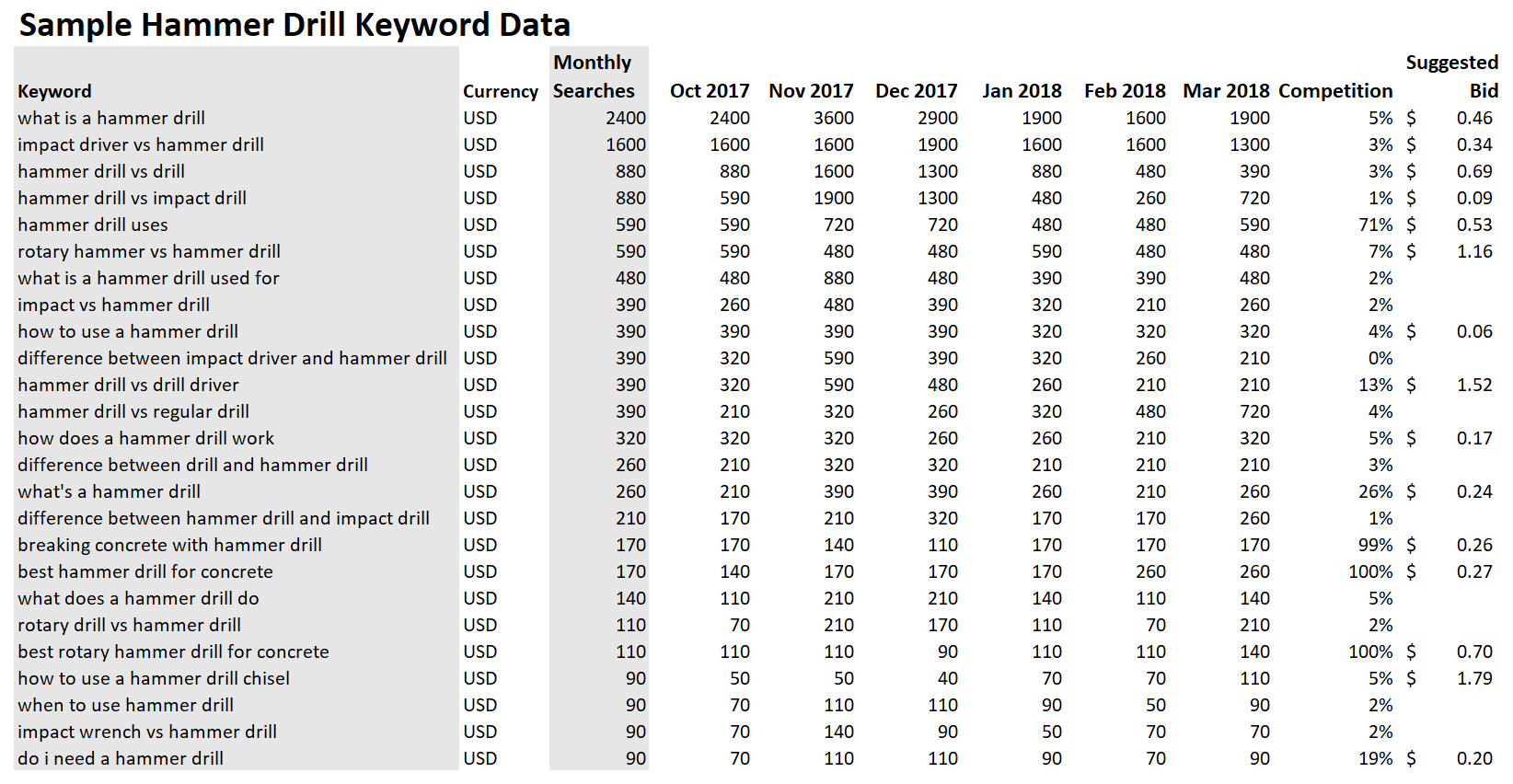

Informational intent keyword data on hammer drills from Google Keyword Planner.

“Hammer drills” is indeed an area ripe for long-form content that answers informational intent. Every one of the keywords above implies a question that can be answered in such a way that will lure customers to a site to learn more about a product, and perhaps shop as well.

Several major themes pop out of the list.

- What is it? Define the product for those who have heard about it but don’t know what it is.

- How do I? Explain in general how it might be used.

- Comparative. Compare and contrast the features and uses of similar tools.

- Specialty uses. Concrete is a recurring theme with hammer drills; address dos and don’ts with concrete and masonry.

Remember, each of these content themes comes with quantitative data that can help determine which are the most valuable.

For example, the concrete theme might be great for a low-cost demonstration video, but it only drives 450 searches a month. The comparative theme, on the other hand, drives 6,500 searches a month. Thus content that compares and contrasts would drive more visitors to the site, and would likely sell more products.