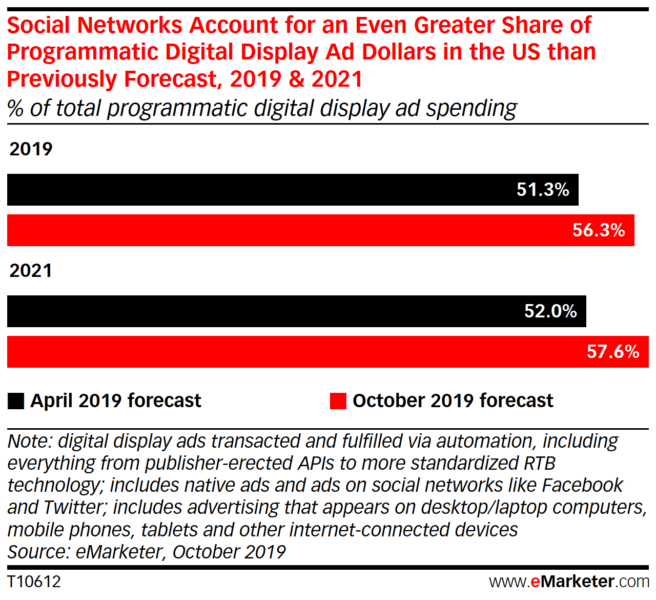

Social is accounting for a higher-than-expected share of programmatic display ad spending. Advertisers in the U.S. will spend more than $57 billion on programmatic digital display by the end of 2019, with 56.3% of that going to ad units on social platforms, a new report from eMarketer predicts.

Social’s share of programmatic display spending is expected to increase to 57.6% by 2021, according to the report. That’s up from eMarketer’s April estimate of 52%.

Note that eMarketer defines programmatic display advertising as “the use of automation in the buying, selling or fulfilling of digital ads,” which includes display ads served through both publisher APIs and impression-based bidding platforms such as Facebook, LinkedIn, or Twitter.

Overall, eMarketer predicts that programmatic display advertising will account for 83.5% of total digital display ad spend this year – and could reach nearly $80 billion by 2021 as technologies evolve. Overall, growth in programmatic display has been steadily slowing as technologies mature.

Why we should care. Automated media buying now represents the primary method of buying digital display media in the U.S. While we may quibble with social being categorized as programmatic, eMarketer’s latest forecast shows just how much social (with Facebook, in particular) is dominating the display landscape. Facebook consumes 83% of social ad spending, eMarketer estimated earlier this year.

Chalk that up, in large part, to the ability to deterministically target based on logged-in user IDs while deteriorating support for third-party cookies has made programmatic targeting on the open web more challenging.

“Advertising in a cookie-free mobile app environment where users spend much of their digital time is complicated and difficult,” said Eric Haggstrom, forecasting analyst at eMarketer. “Social networks prove to be the major exception. They’ve made it relatively easy to target audiences at scale in an in-app environment.”