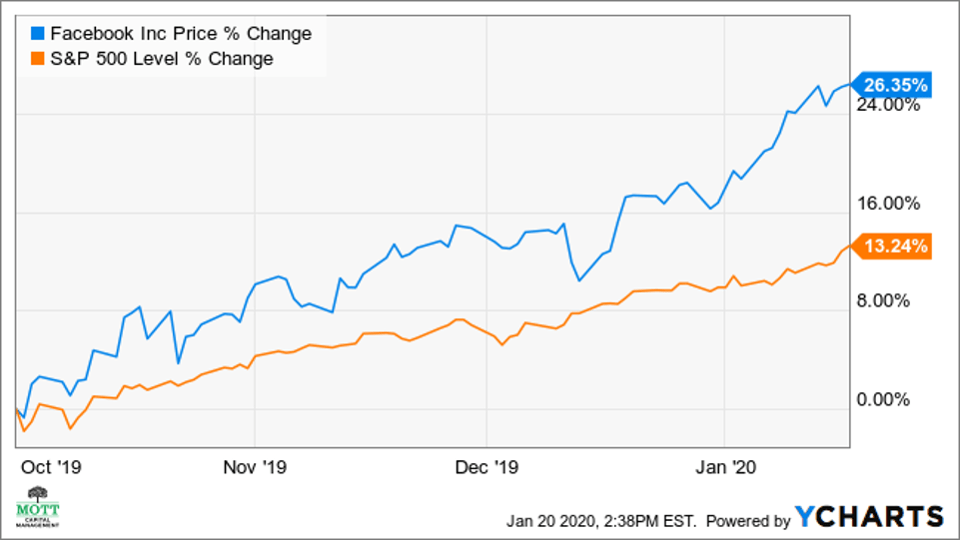

Betting against Facebook Inc. (FB) and its stock has been the wrong call. Shares have powered higher since the beginning of October, rising by over 26%, which is double the pace of the S&P 500 increase during that time. Now, with fourth quarter earnings around the corner, it may not be the time to bet against the stock’s recent move higher.

The company will report fourth quarter results on January 29, following the close of trading. Analysts do not forecast healthy fourth quarter earnings, estimating an increase of 5.6% to $2.51 per share versus the same period a year ago. Meanwhile, revenue is likely to be stronger and is forecast to have increased by 23.5% to $20.9 billion.

Facebook stock versus the S&P 500

YChartsA History Of Beating Estimates

The company has a history of delivering results that beat on both the top and bottom lines. Over the past eight quarters, the company has been able to top earnings estimates eight times, and by a wide margin. However, revenue has been less consistent, topping estimates in just 6 of those periods.

Facebook’s earnings vs. estimates.

YChartsLooking Ahead

Perhaps more important will be the guidance the company lays out on the conference call. Currently, first quarter consensus estimates are for earnings growth of about 10% to $2.08 per share versus $1.89 in the same quarter a year ago. Meanwhile, revenue is forecast to rise by around 23% to $18.6 billion from $15.1 billion in the first quarter of 2018.

Costs for the company will continue to be a focus in 2020 for investors as it was in 2019. Based on the company’s third quarter conference call, those expenses are likely to rise in 2020 to a range of $54 billion to $59 billion. That is higher than Facebook’s expectations for costs in 2019 of $46 billion to $48 billion. Additionally, the company noted it expected 2020 capital expenditures to rise to $18 billion at the mid-point from $16 billion in 2019.

The Options Market Indicates The Shares May Rise

The options market is not expecting much in the way of surprises following Facebook’s results. Currently, the long straddle options strategy indicates that the stock is likely to rise or fall by around 7% from the $230 strike price for expiration on February 21. It places the stock in a trading range of $209 to $241.

Open Interest

Trade AlertThe stock has seen some bullish option betting going into the results for the February 21 $210 strike price calls. Since the beginning of the year, the number of open contracts has increased to 25,000, from approximately 11,700 contracts on January 2. It appears that the majority of the open interest increase occurred on January 10. According to data from Trade Alert, 14,500 of the calls traded on January 9 on the ASK for $13.65. It is a bet that Facebook’s stock will stay above $223.65, following the company’s quarterly results.

Technical Trends Are Bullish

The technical chart suggests that Facebook’s stock rises by an additional 7% after reaching a new all-time high closing around $222 on January 17. The trend in the shares is higher at this point and suggests it climbs to around $238 in the weeks ahead, based on a projection of the move higher in the stock from December 13 through January 13. Additionally, the relative strength index is suggesting that momentum has moved into Facebook, and supports the stock rising longer-term.

Facebook technical chart

TradingviewFacebook may have history on its side when it comes to reporting results and even the potential for the stock gaining in the weeks ahead.

Michael Kramer is a financial market strategist and the portfolio manager of the Mott Capital Thematic Growth Portfolio.

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future results.