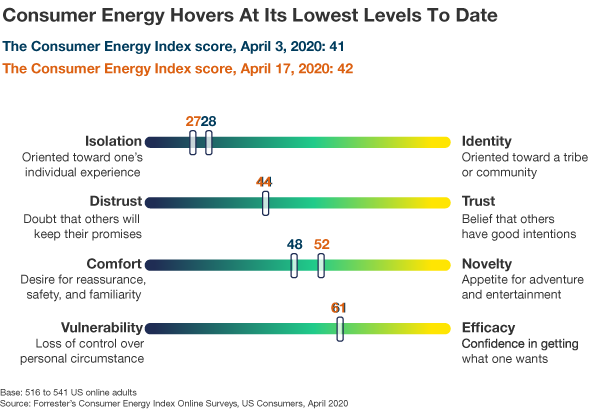

To measure precisely what kind of emotional toll COVID-19 is taking on consumers — and how current consumer sentiment will influence imminent behavior — we are applying Forrester’s Consumer Energy Index, our data-driven framework that captures how ready and willing consumers are to reach out to brands.

The onset of COVID-19 in the US in early March precipitated a dramatic drop in consumer energy; this energy continued to diminish through early April. Our latest pulse reveals that the decline of consumer energy is tapering off, as mid-April energy levels are consistent with early-April numbers:

What The Data Means:

- Consumers’ feeling of being part of a group has hit an all-time low. Physical isolation has driven consumers into emotional isolation — and consumers haven’t emerged from this solitary corner. Now they are consumed by the idea of their individual or local identities rather than considering their affiliations with broader communities.

- Consumers still hesitate before trusting organizations. Consumer trust levels haven’t changed since early April, indicating that consumers continue to be skeptical that brands have good intentions and will follow through on their promises.

- Consumer appetite for novelty fluctuates wildly. Over the past six weeks, consumers oscillated between seeking out new information and entertainment and seeking out familiarity and comfort. This ebb and flow reflects the emotional tug-of-war between wanting consistency — which makes people feel safe — and wanting variety — which provides a welcomed diversion. Currently, inclination toward novelty is on the upswing.

- Consumers maintain a mild confidence in their ability to regain control. After consumers’ sense of control weathered the biggest hit when the pandemic initially reached the US, “efficacy” scores have remained consistent. While consumers are less proactive in their pursuit of resources than average, they don’t feel completely powerless over their situation.

What This Means For Brands:

- As we cross the peak of the pandemic, begin strategizing how to rekindle your consumers’ energy. Our previous research shows that consumers with the lowest energy levels pull back from brands the most, while consumers with higher energy levels are ready to tune into brand messaging. The boldest brands don’t only respond to how consumers feel along the four dimensions of consumer energy — they use their voice and experience to dial up consumer energy. Today, the drop in consumer energy is decelerating; within the next few weeks, consumer energy will gradually reignite.

- Revitalize consumer energy by understanding emotional drivers across your key segments. While we are reporting on total US general-population energy levels, data reveals the nuance within consumer cohorts. For example, compared to the average, US consumers ages 18–34 have a significantly higher appetite for novelty, while consumers ages 55-plus default to significantly higher trust levels. While you might infuse your messaging to younger consumers with variety and freshness, you might emphasize the tried-and-true appeals when reaching their older counterparts.

Questions, comments, or ideas? I look forward to sharing more data detail and discussing via inquiry.