Three ways financial services companies are leveraging AI to enhance the customer experience

Artificial intelligence is having a transformative impact on industries and sectors across the world. From retail to manufacturing, advanced AI technology has already changed how we interact and do business with one another. This trend is only going to continue and whilst some worry about a Terminator-style apocalypse, many are looking more optimistically at the opportunities ahead.

The financial services sector has experienced some really interesting developments over the last five years. Changing regulatory compliance requirements and shifting customer demands mean that financial services companies are turning to new technologies to manage different challenges and opportunities. Many of these can be grouped into three broad areas:

- Combating fraud and financial crimes

- Managing credit and regulatory risk

- Enhancing the customer experience

Within this post, I’d like to look at some of the ways financial organizations are using AI to enhance the customer experience. Whilst the three areas above do influence one another, I’m interested more specifically in how AI is impacting financial companies’ marketing strategies and how they shape our day-to-day experiences with them.

Customer, technological and regulatory disruptions

As with many other sectors, there are a number of trends and factors disrupting the banking and finance industry.

Customer demand and expectation

Digital has heightened customers’ expectations of service. The ‘Amazon effect’ means that we now demand better and quicker customer service in an age of instant gratification. Ten years ago I remember visiting a branch or struggling online to view my balance or make a transaction. Today, I can access everything I need on my mobile using fingerprint ID and make payments and transactions at my own convenience.

The rise of fintech

New entrants into the market are disrupting the status quo. The big, established banks and building societies cannot be complacent. Companies such as TrueLayer, Monzo and Nutmeg are responding to customer trends and bringing new ideas to market quickly. Unlike larger organization, they are not restricted by complexity and can test and learn more freely.

Regulatory compliance

Regulatory compliance is changing all the time and the penalties of falling foul of the rules can be very costly. The risks involved means that some larger organizations shy away from confidently embracing disruptive technologies. However, the customer of today expects both a first-class customer experience and tight security so there needs to be a view of how these two competing priorities can be merged.

The changing role of AI in financial services

In the context of the trends and disruptions above, AI can provide financial companies with a pathway to success. However, the term ‘AI’ is very wide-ranging and encompasses a number of different areas:

- Machine learning

- Natural language processing (NLP)

- Computer vision

- Forecasting and optimization

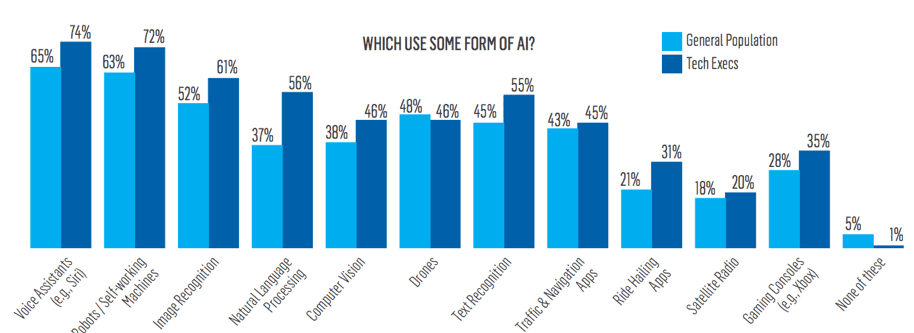

Edelman’s 2019 AI awareness study indicates that whilst people are generally aware of voice assistants and chatbots, they don’t know about other forms of AI used to power these technologies, such as NLP and computer vision. This suggests that many people understand that AI is currently used in some form within many consumer products, but there’s less knowledge of how it works.

[Image source: Edelman,2019]

This knowledge gap may affect consumers’ appetite for new technology. Money is a very emotive subject and any perceived risk to our financial security can result in a breakdown in trust. It’s therefore important for financial companies to innovate with prudence and be open and transparent as to how AI is being used.

Both fintech startups and larger banks and building societies are using many forms of AI to enhance the customer experience today. Here is a selection of some of the most interesting and innovative examples:

Chatbots

Chatbots are AI-powered virtual assistants. They are one of the most well-known examples of AI and have grown in prominence since the growth in mobile banking. The most effective chatbots are those that can reliably interact intelligently with customers to enhance the on-boarding process, sell new products and answer common questions quickly by anticipating responses.

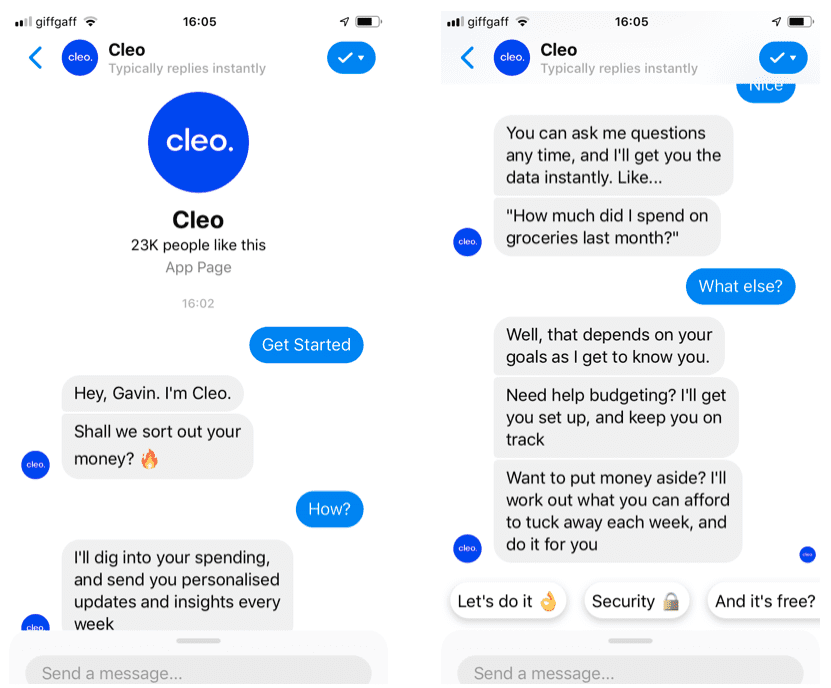

Cleo is a London-based chatbot that sits on Facebook’s Messenger platform. Cleo’s AI proactively helps users to manage their finances by notifying them of income and expenses. Whilst users can access all this information via their bank or building society, Cleo proactively sends notifications tailored to each user:

Although chatbots like Cleo might make suggestions based on a user’s specific circumstances, the user is always in control and can make changes to the frequency and tone of the contact. Whilst this already appears futuristic, chatbots are likely to evolve further and become increasingly proactive. With users’ consent, they will act as savings coaches and suggest changes to accounts (something Flipper is already doing for utilities).

Real-time insights and recommendations

One of the most powerful ways AI is transforming the customer experience is by supercharging the organization and insight of customer data. By using machine learning and natural language processing, financial companies can look at customers’ behaviour patterns and financial history to make relevant, timely product recommendations.

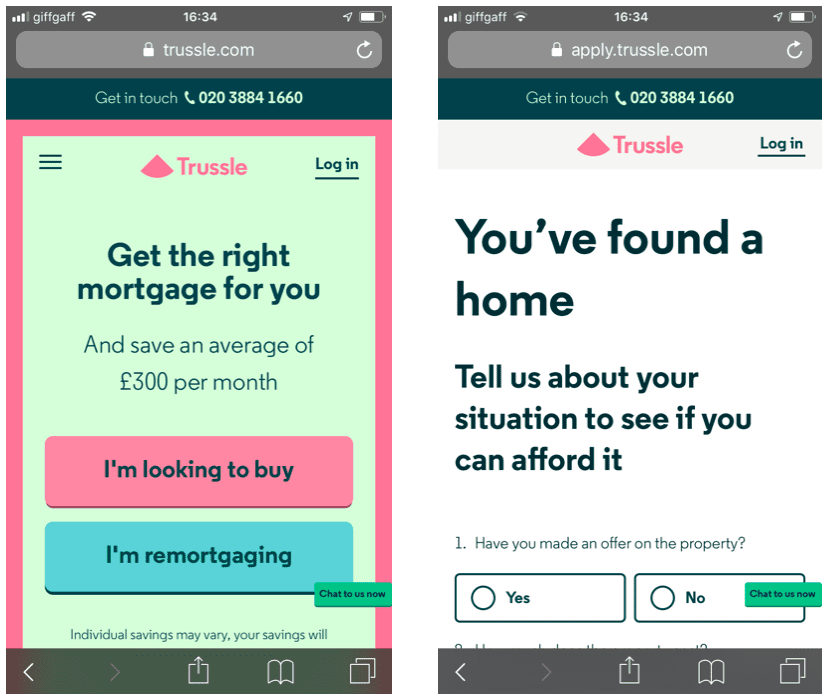

These same processes also enable companies to credit score customers much more quickly and enable users to identify products based on their personal criteria. Trussle, launched in 2016, has moved the entire mortgage process online. The company uses masses of data and AI (machine learning) to make it easier for people to ‘switch’ mortgage when a better deal or lower interest rate becomes available.

A large proportion of UK consumers have more than one bank account, in addition to other financial products from different providers. Although people can go to their bank or building society for financial guidance, providers such as Trussle and Habito provide fast, hassle-free results without the need for face-to-face appointments.

According to venture capitalist and early fintech investor Tara Reeves, the regulatory backdrop is also changing:

“Open Banking is here and the Second Payments Directive Service (PSD2) is accelerating big industry shifts. There is a rising niche of products and technologies offering consumers very specific banking products or financial services.”

Personalized digital experiences

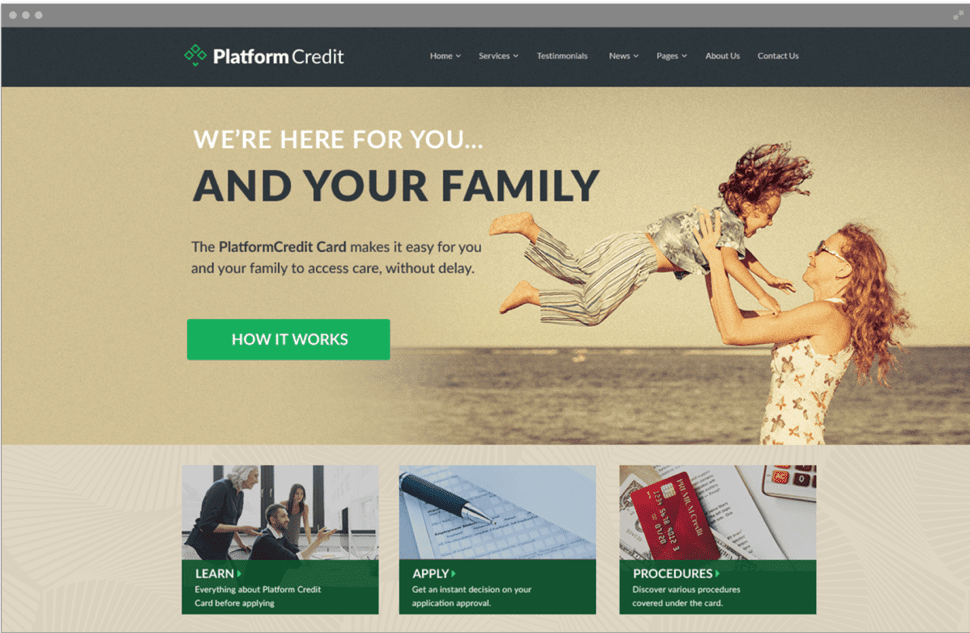

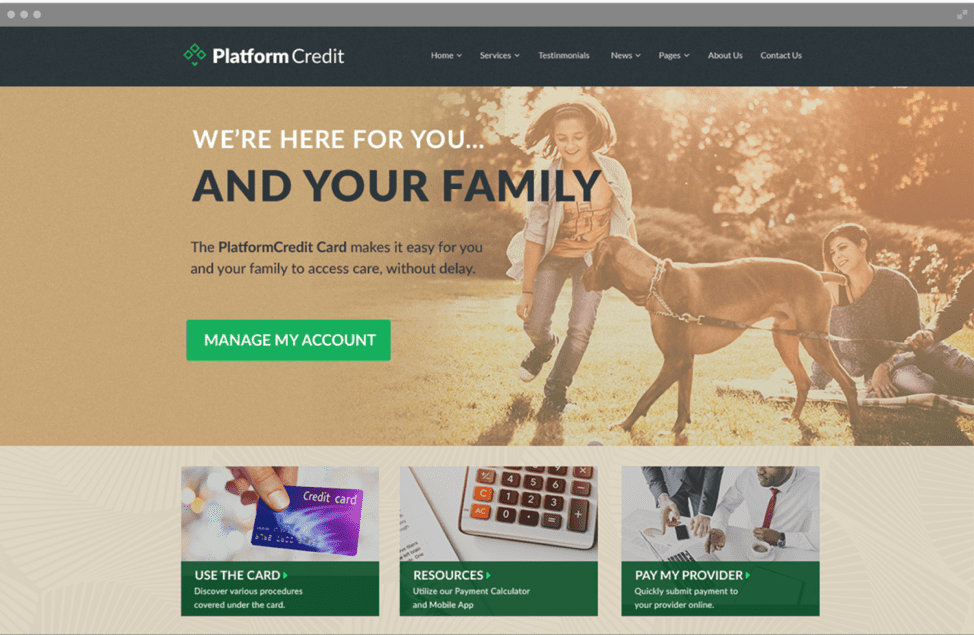

Artificial intelligence and machine learning can be used to understand which digital experiences work best for different customers. Whether it’s a website or mobile app, marketers can use A/B testing to determine which pages and screens perform best in terms of engagement, interactions and/or conversions. However, whilst a standard A/B test may reveal that one option generates a 70% conversion rate and another 40%, there’s clearly something about the second option that’s working for some users.

It would be very difficult to manually identify the characteristics of people who prefer the second option. In this situation, machine learning can quickly analyse the data that’s been acquired on previous visitors to determine the best-converting pages/screens. By providing more personalized layouts and information architecture, users are served content that is much more meaningful and relevant to their situation.

New visitors

Returning visitors

Summary

Financial organizations have an opportunity to test, learn and develop new AI technology to enhance the customer experience. Despite the potential regulatory risks, if tested and implemented in the right way companies can find a good balance between security and customer experience.

Financial services companies must innovate and move with the times to meet changing customer expectations otherwise they run the risk of falling behind nimbler competitors. One option may be for larger organizations to partner with smaller fintech players to take advantage of new technologies. Whilst this isn’t a guaranteed solution, it may offer a route to improving the understanding and opportunities of AI to deliver a better all-round digital experience for customers.