Faced with

disruptive competition, what can an established brand do to protect its

franchise? Using data from Kantar’s BrandZ database we will explore what makes

a brand disruptive in the eyes of potential customers and what legacy brands

can do to fight their corner.

Challenging times

For all the hype

surrounding them, things are not looking so good for disruptive brands these

days. Tesla, Netflix and Uber all face significant challenges if they are to

turn a profit, and their share prices are down significantly from their initial

opening. Meanwhile, legacy brands struggle to defend themselves against new

competition enabled by technology and funded by seemingly limitless venture

capital. With both Disruptors and Defenders facing challenges, are both

destined to collapse? Our analysis finds that it takes far more than innovative

technology to ensure a successful transition from start-up to established and

profitable brand. Both Disruptors and Defenders need to identify and amplify

what makes them unique.

Disruptors are different by definition

Through extensive

research designed to predict consumer behavior, Kantar has identified three topline

equities that power a strong brand:

Difference: This is a

brand’s competitive edge. If a brand is perceived to be unique or setting the

trends for its category, it is more likely to justify a price premium over

direct competition.

Meaning: This the

foundation on which a strong brand is built. If a brand is perceived to meet

people’s needs and is liked more than others, people are more likely to want to

buy it.

Salience: This is a

brand’s main growth lever. If the brand comes easily to mind when a need arises,

it is more likely to be bought.

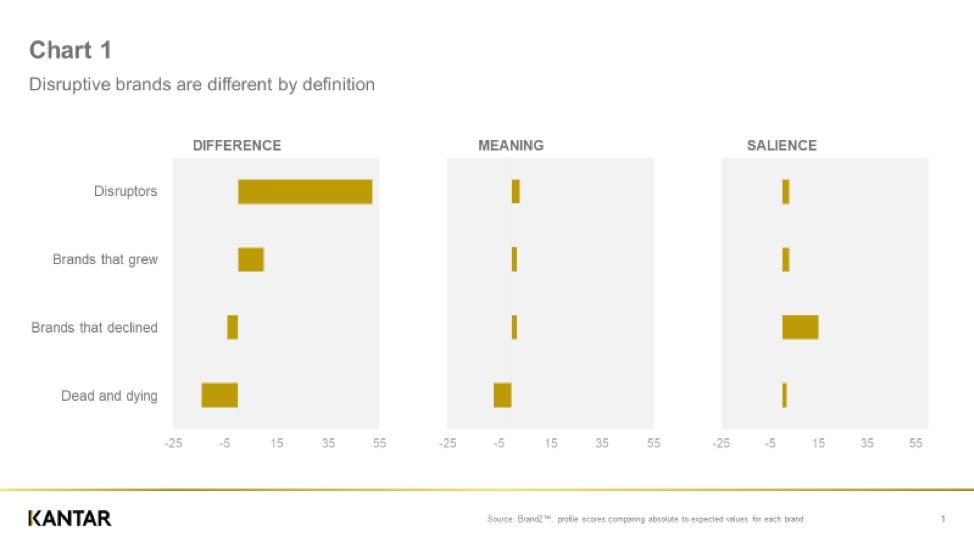

Chart 1 compares the relative strengths and weaknesses of four different types of brand from the BrandZ database: disruptors, growing brands, declining brands and dead brands [1].

It is immediately

obvious that disruptors are different by definition. Airbnb is not your

standard hotel offering, Tesla is not a typical car and Uber is not a normal

taxi service. But what is also apparent is that more normal brands also benefit

from a clearly articulated difference. Brands that grew were more likely to be

seen as different than expected in the baseline year of our three-year

analysis. By contrast, brands that declined were more salient than expected,

but tended to lack perceived differentiation. Dead brands were less likely than

expected to be seen as different but were also less meaningful.

Difference alone

is not enough to generate growth

Of course, simply

being seen as different is no guarantee of success. Brands can be different in

a bad way, and still need to address a real consumer need at the right price.

Remember the Juicero? A $700 juice maker that offered little advantage over

traditional methods and yet attracted $120 million in funding from top venture

capitalists during its two-year lifespan. In general, brands grow by

identifying a difference with the potential to be meaningful to a wider

audience and then making the brand and what it has to offer as salient as

possible. While some innovative brands may be able to establish their perceived

relevance prior to purchase, most brands only establish their meaning when

customer experience confirms expectations that the brand meets their needs and

familiarity helps engender affinity.

It takes more than technology to be different

It seems

symptomatic of the times that start-ups, scaling fast in hope of future

profits, attract all the attention, while legacy brands, making a good profit,

languish unnoticed. Simply adding the word “technology” to a company’s pitch to

venture capitalists automatically attracts more interest. Even companies that one

might not expect leverage the word to good effect. Lululemon, the

athleisurewear company, positions itself to investors as a technology company based

on its design and material patents.

But the problem

with technology – particularly apps – is that it rarely provides a lasting

advantage. Faced with competitors with similar capabilities, brands must resort

to more traditional means to establish competitive advantage. Take the example

of Tesla. When compared against a portfolio of mainstream car brands Tesla is

perceived to be hugely different and environmentally responsible. However, in

the context of Electric Vehicles in China, Tesla’s differentiation looks less

overwhelming when compared to the likes of BMW, VW and local giant BYD. Tesla

may still be the disruptor but must now play to more traditional strengths like

great design rather than being good for the environment. The pattern we see for

Tesla is one that is repeated across many product and service categories

disrupted by new technology like banking, entertainment and mobile phones.

First-mover technology may get the brand off to a good start, but as soon as me-toos

arrive on the scene perceived differentiation starts to evaporate. It is then

incumbent on the first mover to play to strengths that truly differentiate it

from the new competition in a way that is meaningful for potential customers.

Defenders need to play to their strengths too

A few years ago,

most commentators assumed that US retailer Best Buy was likely to follow in the

footsteps of Circuit City and other retailers sidelined by the rise of Amazon.

Instead, however, Best Buy has undergone a resurgence in sales and profits as

it has worked to blunt its competitor’s advantages and amplify its own. Under

the leadership of CEO Hubert Joly, Best Buy’s “Renew Blue” saw the brand match Amazon’s prices and speed, while

focusing on delivering a customer experience the online giant could not deliver.

Far from being the death of the brand, “showrooming” became its advantage,

allowing Best Buy’s retrained staff to engage with customers and help them make

the right choices. The company expanded its customer service efforts beyond the

well-known Geek Squad to create an adviser program, which offers customers free

in-home consultations on what products to buy and how to install them.

In the UK,

traditional banks are discovering they still have a valuable role in people’s

lives, even as Millennials flock to fintech brands like Monzo, Revolut and

Starling. The digital disruptors speak to the needs of a new, mobile-empowered

generation but that does not mean they replace the traditional banks for everything.

Many customers of new digital

banks still have their main account with a traditional institution and take a

portfolio approach to managing their finances through multiple accounts. The

challenge to the established brands is to find ways to leverage their advantage

of in-person service to meet customer needs in ways that the disruptors cannot

match.

Conclusion

Changes in

technology are disrupting industries around the world, but ultimately it is not

the technology that matters. What matters is how brands leverage that

technology to make people’s lives better in ways that people believe the

competition cannot match. A perception of difference is just as important as a

real difference. But it also requires that the brand matches what it has to

offer with people’s evolving needs and expectations. And that finding offers

hope for legacy brands facing disruptors in their own category. Established

brands can survive and prosper if they identify their own unique advantages and

make them salient and meaningful to a wider audience.

[1] Disruptors were identified by searching on the words “disruptive brands” and then cross-referencing with the BrandZ database, taking the earliest occurrence. Growing and declining brands were identified from 3,907 brands measured in BrandZ and compared over a three-year time frame, data is from the baseline year. Dead brands were measured in BrandZ a year or more before being declared dead or bankrupt.