Written by Robert Kovacs

Introduction

After a brief 5 days of analyzing advertising stocks, we’re turning to consumer goods. High-quality consumer staples should outperform the market for the remainder of the bull market, and have lower betas in the case the market drops. But there are also stocks you should avoid at all costs. We’ll look at one of the latter today.

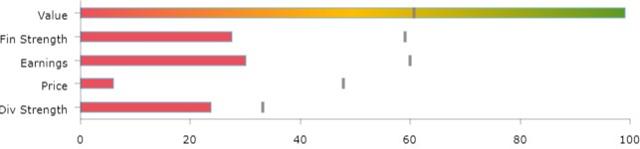

Tupperware (TUP) is currently trading at $18.83 and yields 5.74%. My M.A.D Assessment gives TUP a Dividend Strength score of 24 and a Stock Strength score of 28.

I believe that dividend investors should avoid Tupperware at current prices. Actually, I believe they should stay away at any price. This isn’t the type of company you want to own.

Source: mad-dividends.com

Tupperware is a direct selling consumer products company. It sells food preparation, storage, and serving products as well as cookware and microfiber textiles under the Tupperware brand name.

The company has been selling its goods through Tupperware meetings for the last 73 years, and from the look of it, nothing much has changed.

In the earnings call covering last quarter’s results, management was discussing the implementation of customer relationship management software for its sales force, as well as the roll out of an e-commerce website.

If you didn’t have an e-commerce website in 2012, you were late to the game, but in 2019, you’re the laggard among laggards.

This article will first analyze the company’s potential as an income producing investment. Next it will assess the company’s potential for capital appreciation. Finally it will issue a general recommendation based on those two dynamics.

Dividend Strength

Stocks that have good potential as income investments provide stable, safe dividends with a good combination of dividend yield and dividend growth potential. The higher the yield, the lower the required dividend growth. With TUP, for instance, given the high 5.7% yield, I’m mostly looking for dividend stability, more than dividend growth potential.

Dividend Safety

Tupperware has an earnings payout ratio of 73%. This makes TUP’s payout ratio better than 24% of dividend stocks.

TUP pays 85% of its operating cashflow as a dividend, which is better than 9% of dividend stocks.

TUP pays 805% of its free cashflow as a dividend, which is better than 2% of dividend stocks.

Based on these numbers, I believe Tupperware’s payout ratio to be worrying. The dividend was cut last year by 60%, so going forward these payout ratios shouldn’t be as bad. However, even with the 60% cut, TUP still needs $1 per share in FCF to cover the dividend. In the past 12 months they produced only $0.28 in FCF.

28/03/2015 | 26/03/2016 | 01/04/2017 | 31/03/2018 | 30/03/2019 | |

Dividends | $2.7200 | $2.7200 | $2.7200 | $2.7200 | $2.3100 |

Net Income | $3.77 | $3.96 | $4.48 | $-5.45 | $3.17 |

Payout Ratio | 73% | 69% | 61% | -50% | 73% |

Cash From Operations | $5.73 | $4.54 | $4.48 | $3.77 | $2.71 |

Payout Ratio | 46% | 58% | 58% | 69% | 85% |

Free Cash Flow | $3.42 | $2.50 | $2.19 | $1.49 | $0.28 |

Payout Ratio | 80% | 109% | 124% | 182% | 797% |

Source: mad-dividends.com

TUP has an interest coverage ratio of 7x, which is better than 66% of stocks. This level of coverage is sufficient, and doesn’t add extra risk to the dividend.

However, given the coverage and payout ratios, it would seem like TUP’s dividend is still at risk, despite last year’s dividend cut. Free cash flow has been in free fall for the past 5 years, with no clear pathway to growth.

Dividend Potential

The dividend looks unsafe, which is not a great start to my analysis. Does it have the potential to recover?

Tupperware has a dividend yield of 5.74% which is better than 89% of dividend stocks.

The dividend was cut by 60% during the last 12 months, which is always a red flag. I get nervous when stocks freeze their dividend, but investing in a company that just cut their dividend makes no sense to me. The chances that they turn around quickly and resume dividend growth are always so low, that it is rarely worth the risk.

Source: mad-dividends.com

During the last 3 years, the company’s revenues have remained flat, while net income has decreased at a -8% CAGR.

Source: mad-dividends.com

If the company keeps growing revenue and net income at the current rate, TUP’s dividend has weak potential.

The company is trying to focus on transitioning to digital, but may I point out, it is late to the party. Management said in the latest earnings call:

We are also in the process of creating a new e-commerce website which we expect to launch in August of 2019 in the U.S. and Canada. We plan to leverage this site through search engine optimization, influencer marketing, and ad retargeting, all of which will elevate an increased consumer awareness of the Tupperware Brand and generate leads to new consumers.

The way this is worded makes me feel like they are not very aware of how these things work. SEO isn’t a magic wand you wave. Since most site juice will come from authority and outbound links, TUP will have to invest massively in link-building campaigns, which will yield results one to three years down the line.

Next, influencer marketing is where they should have been from the start. The second people started becoming Instagram “influencers,” somebody at TUP should have pointed out that it fits perfectly into the company’s business model. In 2019 it’s becoming crowded, and it is becoming more competitive to compete online. Companies that are just starting out with no knowledge or history of success have an uphill battle to fight.

Finally, the same applies to retargeting ads. While they can be very successful, running profitable campaigns doesn’t happen overnight, and TUP will want to make sure it hires the right people to optimize their campaigns and find a voice which works online.

Dividend Summary

If this were 2012, it would be a reasonably late time to enter the digital space. In 2019, it is blatantly late, and I have no confidence in a company that waits until its revenues are down 25% from historical highs before rolling out adjustments.

TUP has a dividend strength score of 24 / 100, which doesn’t make it a great dividend investment.

Stock Strength

If TUP doesn’t have the potential I need for it to be included in my portfolio, maybe it has the potential for capital appreciation? To assess this, I look at four factors which have dictated stock performance for the better part of the last century: value, momentum, financial strength and earnings quality.

Value

The value factor is always where I start my assessment of capital appreciation potential. Undervalued stocks tend to outperform overvalued stocks. However at the very extremes of the factor, value traps arise.

- TUP has a P/E of 5.94x

- P/S of 0.46x

- P/CFO of 6.92x

- Dividend yield of 5.74%

- Buyback yield of 4.87

- Shareholder yield of 11%.

According to these values, TUP is more undervalued than 99% of stocks, which is somewhat worrying. What this tells me is that investors have no faith in the business, since collectively they don’t believe it is worth more than half the revenue it can generate in a year.

Source: mad-dividends.com

As you can see, TUP is currently trading at rock bottom low multiples of earnings. The market has discarded this stock as dead in the water, and as long as top and bottom lines keep declining, there is no saying how much lower the price could go. Sometimes in these situations I hear people say, “Surely it can’t go much lower.” May I point out that a stock can always go down by as much as 100%.

Value Score: 99 / 100

Momentum

To avoid value traps, investors can look at momentum alongside value. Undervalued stocks which are trending upwards are my favorite type of stocks. Undervalued stocks which are heading down pose a similar dilemma as overvalued stocks going up: one might ask how much lower they can go? I have no appetite for catching falling knives (or falling Tupperware kitchenware for that matter) and will not invest in stocks on the way down. You can read why in this blog post.

Tupperware trades at $18.83 and is down -25.31% these last 3 months, -42.04% these last 6 months & -53.77% these last 12 months.

Source: mad-dividends.com

Stocks with the worst momentum unfortunately often continue to underperform the market. Tupperware is among the 6% of stocks with the worst momentum. The likelihood that the stock turns around and outperforms within the next 12 months is close to non existent.

Momentum score: 6 / 100

Financial Strength

TUP has negative equity, preventing analysis of the company’s gearing. A look at the company’s quick ratio shows it has been below 1x for the past 8 quarters. The company’s liabilities have increased by 4% over the course of the last 12 months. The company’s operating cashflow can cover 8.2% of liabilities.

This makes TUP more financially sound than 27% of U.S. listed stocks. The company’s lackluster performance these past few years has deteriorated the company’s financial position, which further reduces my confidence in TUP.

Financial Strength Score: 27/100

Earnings Quality

Finally I take a look at the company’s earnings quality.

TUP has a Total Accruals to Assets ratio of -0.9%, which is better than 20% of companies. It depreciates 19.3% of its capital expenditure each year, which is better than 5% of stocks. Finally each dollar of assets generates $1.4 in revenue, which is better than 87% of stocks. This makes TUP’s earnings quality better than 30% of stocks.

The only thing that TUP has going for it is its high asset turnover, due to the nature of its business model. However, as the company loses sales force members, who are the company’s real assets, top line has been decreasing.

Earnings Quality Score: 30 / 100

Stock Strength Summary

When combining the different factors of the stocks profile, we get a stock strength score of 28 / 100 which is appalling. When you have a stock that has under average fundamentals, and decreasing top line, the valuation loses its meaning.

Conclusion

With a dividend strength score of 24 and a stock strength of 28, Tupperware is an awful choice for dividend investors.

Management should have attended fewer Tupperware parties and instead joined the e-commerce party that has been happening for 15 years.

I see no way out for the company, as I don’t believe it will be able to replace the decline in revenues with online revenues, at least not in the next 2 to 3 years, and therefore wouldn’t touch TUP with a stick.

Liked this article? Click the orange “follow” button to get notifications when we release our next dividend article.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.