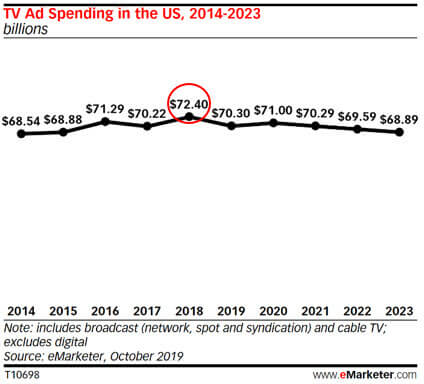

Traditional TV ad spending in the U.S. will decline roughly 3% this year and is in the midst of a long-term decline, according to eMarketer. The firm says that “TV ad spending peaked in 2018 at $72.40 billion.” By comparison, digital ad spending (all formats) is now more than 50% of overall ad revenue.

Video on other platforms growing. Digital video formats, by contrast, are seeing increased spending. Connected TV (CTV), for example, is growing, according to eMarketer. Defined to exclude linear TV and video on PCs and mobile devices, eMarketer says that CTV will reach nearly $7 billion this year and $12.5 billion by 2022. By 2023, the firm says “advertisers will devote almost 5% of their paid media budgets to connected TV placements.”

As streaming offerings give consumers more choice and the ability to avoid paying for cable channels they don’t watch, cord-cutting is accelerating. The five largest U.S. pay-TV providers lost more than 4% of their subscribers last year. And for the first time last year, global streaming subscribers surpassed cable subscribers.

Just 73 million pay TV subscribers in 2023. Emarketer reports there are 86.5 million pay TV subscribers in the U.S., declining to 72.7 million by 2023. It further projects there will be 22 million cord-cutting households in the U.S. this year.

Time spent watching TV (though not video) is also going down according to eMarketer. All age segments are now watching less TV but the steepest decline is among those 17 and younger.

Why we should care. TV had resisted disruption longer than any other traditional medium. However, that’s now happening. The good news is that as an awareness and branding medium TV is highly effective. And if audiences and ad spending continues to decline, rates will become cheaper for marketers. Indeed, many direct-to-consumer brands have complained about the cost of digital and are allocating more of their budgets to traditional media — especially TV.