Last week, BrightLocal published the Local SEO Industry Survey 2014, which is an annual exploration into the state of the industry for SEOs serving local businesses. This was also covered here on Search Engine Land.

In this survey. We compiled data from over 1,700 SEOs answering 19 questions on areas such as company size, client acquisition, financial turnover and future outlook.

The results make for interesting reading; but, as always with industry studies like this, they raise as many questions as answers. Questions which, given the large amount of data at our disposal, we felt we could address in further analysis.

In the following analysis we’ve taken the step to look deeper at the data we collected and examine responses against other questions.

For example, it’s useful to know that 10% of these SEO agencies have a turnover of more than $500,000, but which type of agencies make up this 10%? And how does that compare to the number of SEOs working on their accounts?

1. Type Of Business Vs. Business Turnover

How does the size of an SEO agency/consultancy relate to its turnover? We compared responses from the full survey to find out. (Please note that in-house SEOs have been removed from the chart).

Type of business vs Business turnover

Key Findings:

- 55% of freelance SEOs earn less than $30,000

- 31% of national agencies earn more than $500,000

Analysis:

It is the two extremes of the chart that make the most interesting reading? We can see that freelance SEOs (red line) are the group that have reported the lowest overall turnover, with over half of them earning less than $30,000 per annum.

National agencies (yellow line), which by their very definition, should be pitching to larger clients with more expansive budgets, are the group that reported the highest annual turnover — with nearly 1 in 3 earning more than $500,000 per annum. Below are some of the landmark figures from the chart:

Turnover = Less Than $50,000:

- 69% of freelance SEOs

- 50% of web designers/agencies

- 48% of local/regional agencies

- 28% of national agencies

Turnover = Less Than $100,000:

- 89% of freelance SEOs

- 66% of web designers / agencies

- 64% of local / regional agencies

- 41% of national agencies

Turnover = More Than $150,000:

- 6% of freelance SEOs

- 25% of web designers/agencies

- 24% of local/regional agencies

- 53% of national agencies

2. Business Turnover Vs. Number Of Clients To Personally Look After

How does the annual turnover of a local SEO agency or consultancy compare to the workload assigned to its staff? In the following chart, we looked at how many clients an SEO is personally responsible for, based on the turnover of that business.

Business turnover vs. Number of clients to personally look after

Key Features:

- Direct correlation between earnings and expected workload for SEOs

- In businesses earning more than $150,000, local SEOs are expected to look after 15+ clients

Analysis:

The results from this chart are as you would expect. Those search agencies that employ SEOs to look after multiple clients are those which will generate the biggest turnover.

It shows that an agency will work its SEOs hard in order to generate income! Of course, the type of work undertaken is relative to this stat, and in the Local SEO Industry Survey 2014, Google+ optimization, on-site SEO and citation building were the most popular local search services offered by SEO agencies — which gives us an idea of what our busy SEOs are spending the majority of their time on.

We know that the 31% of national agencies earn more than $500,000, and it is within these agencies that SEOs are expected to personally manage up to 17 clients individually. Of course, SEOs that can successfully juggle 15+ clients are surely able to command a higher wage; thus larger agencies have larger costs.

3. Type Of Business Vs. New Leads Contacted

With SEOs handling multiple clients, how does this relate to new business development? Where do agencies find the balance between remaining competitive and maintaining growth?

Type of business vs. New leads contacted

Key Findings:

- National SEO agencies approach 13 new leads per month on average

- Freelance SEOs approach the least new leads per month (8)

Analysis:

We can see that attracting new business is a major part of the monthly activity for a search business — and one which is particularly important given that so many of them are earning relatively low levels of income.

We saw that national agencies work their SEOs hard, giving them up to 17 clients to personally handle each month. Now we can see how this figure is maintained. By approaching 13 new leads per month on average, it helps to ensure a steady flow of new business coming in which compensates for any existing client departures, or those requiring one-off/short-term tasks.

Freelancers contact the least amount of leads, but this is perhaps understandable given their preoccupation with other areas of their business. These areas may include local search tasks like Google+ optimization, on-site SEO and citation building, and perhaps, client acquisition, invoicing and billing.

In scenarios like this, there may be a catch-22 scenario whereby freelancers would like to take on new business but don’t have the time, resources or even the contacts to do so as successfully as they would like — and certainly not on the scale to match a regional or national agency.

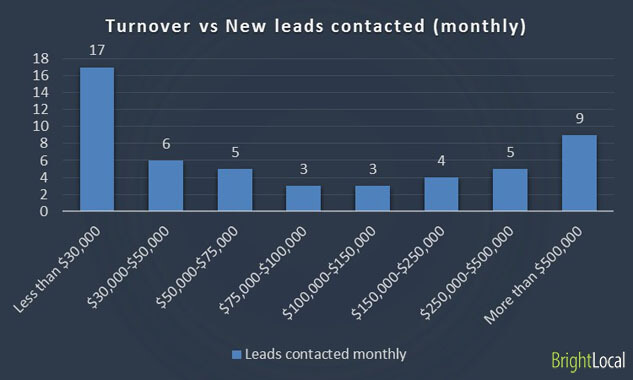

4. Business Turnover Vs. New Leads Contacted

How does the annual turnover of an SEO agency or consultancy relate to their levels of new business development?

Business turnover vs. New leads contacted

Key Features:

- SEOs earning less than $30,000 contact the most new leads (17 per month)

- SEOs earning between $75k-$150k contact the fewest new leads (3 per month)

Analysis:

Those companies with a turnover of less than $30,000 are the most proactive when it comes to targeting new business. Perhaps out of necessity rather than growth ambition?

We’ve already seen that freelancers don’t contact as many new leads as larger agencies. So what makes up the list of SEOs earning less than $30k? As we can see below, it is not exclusive to freelancers.

Turnover = Less Than $30,000:

- 55% of freelance SEOs

- 36% of local/regional agencies

- 31% of web designers/agencies3

- 18% of national agencies

The second highest category of local SEOs contacting the most new leads per month is those with a turnover of more than $500,00 per annum. You could assume, in these circumstances, that the ever-present need to bring in new clients and maintain company growth is a catalyst for new business development.

Taking up the middle ground, we can see that those SEOs with a turnover of somewhere between $75,000 – $150,000 are those that contact the fewest new leads per month.

At both ends of the scale, new business development is driven by necessity; at the lower end there is a need to drive more revenue, whilst at the top end there is a need to maintain existing income or growth.

However, in the middle ground perhaps this is not as prevalent. These agencies may be well established with a comfortable flow of work from regular clients and are happy to continue in their current vein.

Growing an agency to “the next level” may well require more financing, better expertise, and as we’ve seen, a team of SEOs that can look after multiple clients. All of this brings not just more costs but more risk.

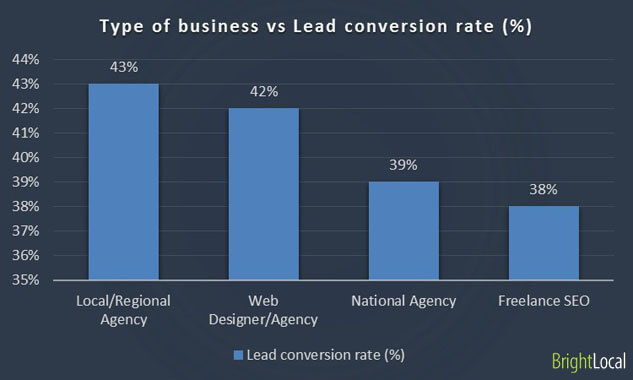

5. Business Turnover Vs. Lead Conversion Rate

Now that we know what types of businesses are pursuing the most new leads, let’s find out which of those are the most successful with client conversion.

Business turnover vs. Lead conversion rate

Key Findings:

- Local / regional agencies have the highest conversion rate with new leads (43%)

- National agencies (39%) & freelancers (38%) have the lowest success rate

Analysis:

We saw that national agencies are the types of local SEOs approaching the most new leads on a monthly basis. However, they are far from the most successful in their endeavours. It is the local/regional search agencies that have the best success at converting clients.

An earlier chart revealed that local search companies earning between $75,000 – $150,000 were those contacting the least new leads on a monthly basis. Looking closer at which organisations which have the biggest presence in that bracket of turnover, it is interesting to note that 19% of local/regional agencies are amongst them — which, incidentally, is higher than any other agency type.

So the conclusion we take is that local/regional search agencies are the best represented bracket of businesses that contact the least amount of leads per month. However, they are also the type of agencies with the highest conversion rate. An enviable position to be in!

So why do national agencies convert new leads at a lower rate? Are clients put off by the thought that their account will be just one of a handful of accounts handled by one SEO? Or is it that national agencies go after larger clients with more stringent requirements?

Multi-location or franchise clients with local search needs are quite the coup for an agency, and so maybe, the high-level of competition makes pitching to these clients a more difficult task — but one that promises greater rewards!

The full set of further insights from the Local SEO Industry Survey 2014 can be found at our Brightlocal blog.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.