If you’ve spent any time following entrepreneurs online, you’ve probably noticed that many of them share how much they make.

It could be as simple as a blog post titled “How I Made $300,000 in One Month” or as complex as a detailed report broken down by revenue streams and expenses.

There are a lot of advantages to sharing this information online — social proof, being their own advertising — but in my opinion, the disadvantages far outweigh them. It’s not something I would ever do for a whole host of reasons, and I don’t think you should either.

Why Do People Share Income Online?

There are four major reasons why people share their income online:

1) Credibility

Consumers want to buy what’s popular, because — so the thinking goes — if everyone wants it, it must be good. If you’re making a ton of money, it means that you’re popular in your chosen field, and that brings credibility.

Credibility is especially important if you’re in the business of teaching other people how to make money. If potential customers see you as successful, they’re more likely to trust your advice and, by extension, sign up for your webinars, pay for your online courses or take advantage of other services you offer.

2) Visibility

If you publish that blog post about making $300,000 in one month, people are going to want to talk to you. Bloggers will blog about it. Journalists will interview you about it. You’ll be known as the entrepreneur making several hundred thousand dollars per month.

That visibility will likely bring you more business (it goes back to credibility) and before long, you’ll be able to hit “publish” on a new blog post about how you made $400,000 in one month.

Related Content: 10 Lessons New Entrepreneurs Can Learn from Steve Chou’s Multiple Six-Figure Successes

3) Accountability

Many bloggers who post income reports also post their goals for the upcoming month. Because thousands of people have seen their intentions, they feel pressure to do whatever it takes to hit those benchmarks.

Some people need external accountability to stay focused on meeting their goals. Those people probably find a huge benefit in publishing their financial goals online, and they might even receive feedback that helps them refine and achieve those goals.

4) Traffic

Income posts are hugely popular, especially detailed monthly reports. If you share them on a regular basis, people will likely come back to read the next one when it’s posted, and then — if you’ve optimized your landing page correctly — stay on your site for more inspiration. You can then use these traffic reports as a gateway to a related premium service.

Why are traffic posts so popular? Because people like aspirational content — and because they’re nosy. Plus, bloggers like to do monthly income report round-up posts, giving extra promotion to those sharing via an already engaged audience.

Dive Deeper:

Who Shares Income Online?

For some niches, sharing income seems like a natural fit. Many bloggers/entrepreneurs in the frugal living, parenthood and food verticals share detailed monthly reports because their readers want to know how they manage to support themselves by blogging.

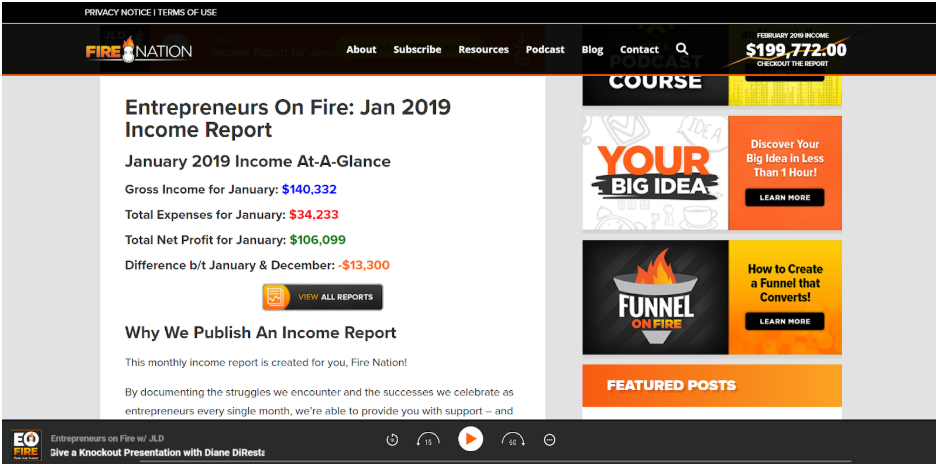

John Lee Dumas of Entrepreneurs on Fire has been sharing monthly reports since 2012, which makes sense for his for-entrepreneurs-by-entrepreneurs niche:

If you Google “monthly blog income reports,” you’ll find even more of these, along with the other kind of income posts — the “How I Made XX in One Month” type. There are plenty of those posts from bloggers in a variety of industries, and it probably won’t surprise you to hear that most of them get a high level of engagement.

Reasons Not to Share Your Income Online

Clearly, there are plenty of reasons why someone might want to share their income online. But there are many more reasons not to and, in my opinion, they’re much more compelling.

1) You Invite Competition

If you’re sharing your income online, then your competitors know exactly how much they need to make to beat you. You had a $300,000 month? They’re going to get even more fanfare when they have a $400,000 one.

Further, if you’re giving a detailed breakdown of where your money’s coming from, then you are 1) giving your competitors ideas for revenue streams they haven’t pursued yet, and 2) letting them know which areas you aren’t dominating, so they can pick up the slack.

Personally, I love looking at other peoples’ income reports. I appreciate how much time and effort they put into them. But if that person is my competitor, I now know how their business works and where I think the holes are in that business. I’m just going to do the things that I see are already working really well for them, and put effort into doing the things that aren’t.

There doesn’t seem to be much advantage when you look at it like that, does there?

Dive Deeper: How to Uncover Your Competitors’ Content Strategy

2) You Could Have a Bad Month

It’s natural to want to share our successes with the world, but our failures? Not so much. If you’ve committed to sharing income reports every month, you can’t skip a month if you don’t hit your goals. People will notice and, because it’s the Internet, they’ll call you out on it.

Some entrepreneurs use their bad months as teachable moments, which may be valuable for their audiences. But broadcasting that you aren’t doing well can negatively impact your ability to acquire new customers, and that should definitely give you pause.

Related Content: How Entrepreneur Gretta Van Riel Used Her 16M Social Media Following to Grow Her Businesses [podcast]

3) You Can Alienate Your Audience

Most people read income reports for the inspiration, but what happens when you make more money than your audience is likely to ever see? You become unrelatable.

There’s a tipping point where your earnings start to alienate your audience — and you might not figure out what that number it is until it’s too late.

Related Content: The 30-Day Strategy to Build an Audience (Without Spending a Dime!)

4) Your Employees Will Start to Resent You

If you have employees, they’ll definitely be looking through those reports. And the more money you make, the more they’re going to demand. The last thing you want is your entire staff demanding a raise when you’ve had a good month, especially if you don’t expect to hit or exceed the same number the next month.

Publishing income reports might also affect your relationships with friends in your industry, especially if you’re more successful than they are. The last thing you want is to leave your peers contemplating whether or not you’ve earned or truly deserve your success.

Related Content: How Adam Callinan Grew BottleKeeper to an 8-Figure Revenue with 0 Employees in 3.5 Years [podcast]

5) It’s Time-Consuming

If you’ve ever put together an income report, you know it can take several hours. Add in writing additional blog copy, building the page, tweaking the SEO and publishing it, and that’s a whole lot of time out of your workday. It might actually be an entire workday.

If you’re an entrepreneur or in a startup environment, you don’t have that kind of time to waste. Those hours would be much better spent growing your business.

Related Content: 10 Ways Successful Entrepreneurs Stay Productive All Day Long

6) People Might Want to Sue You

When people find out you have money, they will try to find a way to take some of it. That makes you a potential victim for frivolous lawsuits.

In a recent episode of Marketing School, Neil Patel expressed regrets over blog posts that broadcasted his wealth, like How Spending $162,301 on Clothes Made Me $692,500 or Why I Spent $500,000 Buying a Blog That Generates No Revenue. He said he’s been sued several times because, while he doesn’t explicitly state his income online, people make assumptions about how much money he has based on his blog post statements, and they want to try and get a piece of it.

7) It’s a Privacy Issue

You’ve got all your online accounts secured with two-factor authentication and impossible-to-guess passwords. So why would you then go and put up information for thousands of people to see that could potentially compromise your privacy?

You’re basically putting a target on your back.

Related Content: 6 Tips for Securing Your Data from Cyber Attacks as a Remote Worker

8) It Only Tells One Part of Your Story

There are so many different factors that go into your monthly inflows and outflows. Some have to do with market conditions. Others have to do with the extra expenses that come with a growing business. Still others have to do with personal issues.

If you’re dealing with a personal tragedy and it negatively impacts your income, do you really want to have to share your private business with those who are reading your blog? Considering that the alternative is just glossing over a bad month, it seems like there’s no good way to handle the situation.

Why Pat Flynn Stopped Sharing Income Reports Online

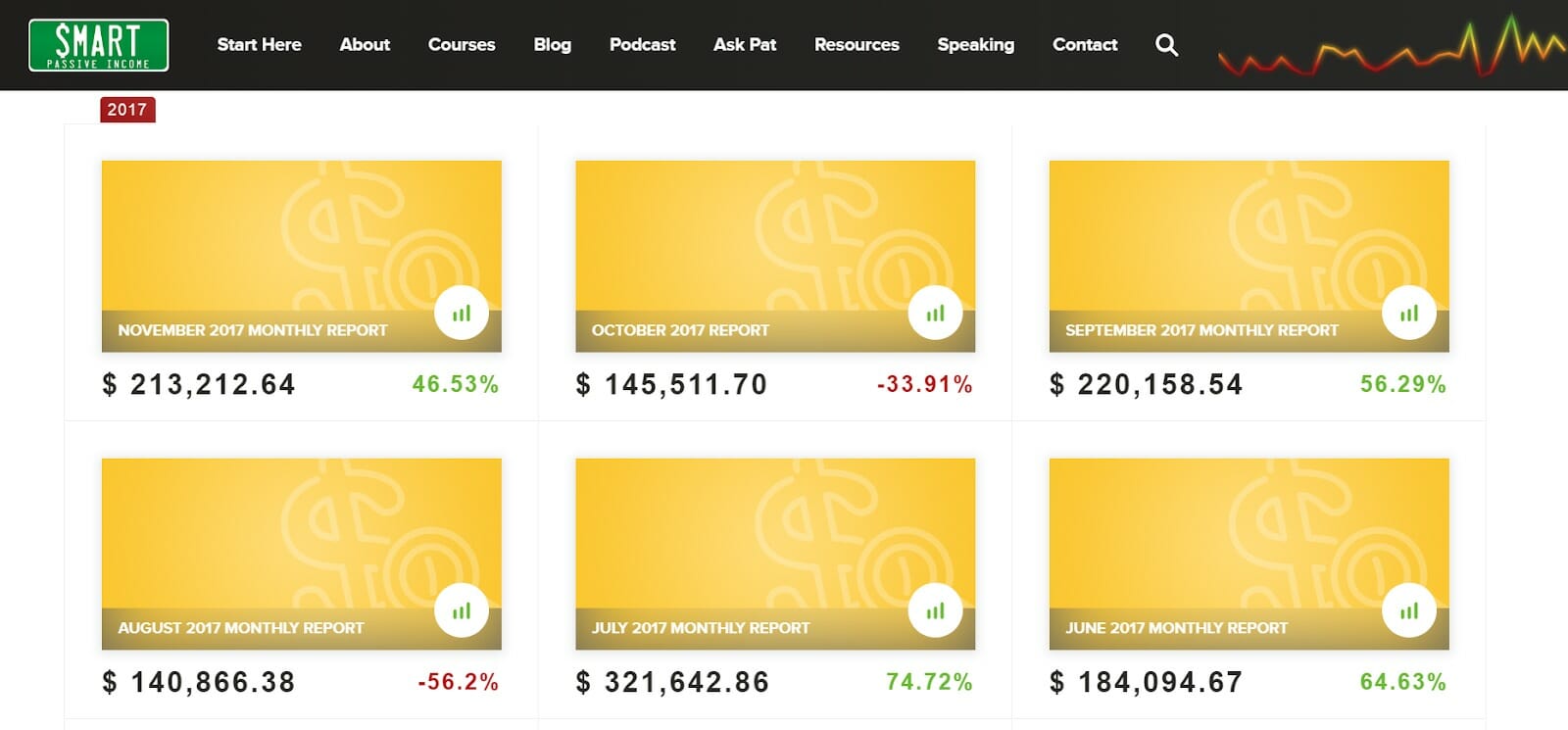

Pat Flynn of Smart Passive Income was a pioneer in sharing detailed monthly earnings reports. He did it for years with the goal of telling readers the truth about how much money you can really make online.

In January of 2018, he decided to stop, citing three reasons:

- They were becoming less and less relatable. The more money he made, the more that people felt he was doing something they could never achieve on their own.

- They took too much time to publish. Pat estimates that by not doing the reports, he saved 10-12 hours each month that were better spent working on other aspects of his business.

- They were becoming less valuable to readers, which Pat cites as the most important factor in his decision.

Pat still wanted to inspire his readers to success, though, so he decided to focus on income generated from one successful campaign at a time, and do a deep dive into how he did it. His readers commented that they found his new approach insightful, useful and interesting.

Don’t Share Your Income, Unless…

I hope that after considering all these points, you realize that any benefit of sharing your income online is largely outweighed by the disadvantages.

I will offer one exception, though: If you want to share your income early on when you don’t have a ton of traction, that may be fine, because your inflow will be so low that it won’t attract the kind of negative attention it will when you start really raking in the dough. It may even help you build a following, as people will be interested and invested in your success.

But once you build up your audience and the income follows, share less or, better yet, not at all. Your family and close friends will be more than happy to help you celebrate your successes, and you won’t have to worry about those successes (along with your failures) negatively impacting your business.