At its launch event in Paris in March this year, Huawei unveiled

two new smartphone models, the P30 and P30 Pro, as the latest

additions to its flagship P30 line.

Last year, Huawei had chosen to use two technologically

different glass-substrate-based displays for its P20 and P20 Pro

models. The P20 display is a 5.8-inch full-high-definition-plus

(FHD+) low-temperature polysilicon thin-film-transistor (LTPS TFT)

LCD with screen resolution of 1080 x 2240 pixels. The P20 Pro

display is a 6.1-inch FHD+ rigid AMOLED with the same screen

resolution as the P20.

This year, however, Huawei elected to use AMOLED for its new P

series, changing the display’s shape and aspect ratio to support

more full-screen features. The P30 display is a 6.1-inch FHD+ rigid

AMOLED with 19.5:9 aspect ratio and screen resolution of 1080 x

2340 pixels. In comparison, the P30 Pro display is a 6.5-inch FHD+

flexible AMOLED with the same aspect ratio and screen resolution as

the P30. Furthermore, the notch design in both displays have been

changed in shape from a rectangle to what resembles a drop of

water.

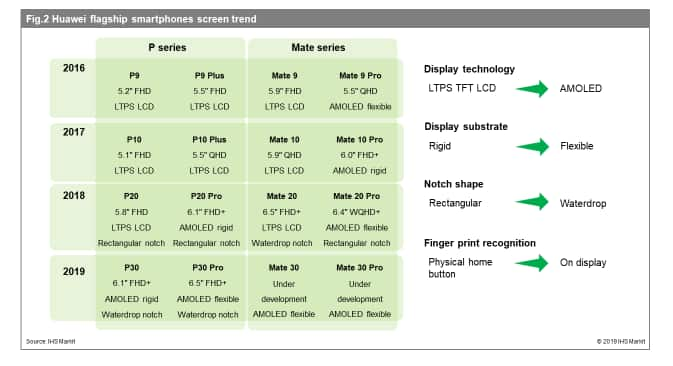

The figure below shows the Huawei P-series smartphones,

including the two newest models in its P30 flagship lineup.

The switch to AMOLED has impacted the company’s display supply

chain.

In 2018, both Japan Display and LG Display provided the LTPS TFT

LCD panels for the P20, while Samsung Display supplied the rigid

AMOLED panels for the P20 Pro. With the adoption of AMOLED for the

P30 series, the LTPS TFT LCD suppliers were booted from the supply

chain, opening the door for China’s BOE to take their place.

Since then, BOE has become a successful supplier of flexible

AMOLED, with panel shipments increasing sharply from Q4 2018 after

starting up delivery for the Huawei Mate 20 Pro. BOE has also been

victorious in supplying flexible AMOLED for the P30 Pro, with the

maker able to maintain stable production. LG Display, meanwhile,

has the capability to supply displays for both the P20 and P30 Pro,

yet appears to struggle in beginning the mass production of

flexible AMOLED for the P30 Plus.

Overall, Chinese smartphone OEMs are increasingly adopting

AMOLED for high-end smartphones. This is also true of Huawei, which

is rapidly replacing LTPS TFT LCD with AMOLED on its flagship

smartphones, as the figure below shows.

With a self-emitting display, AMOLED achieves wider contrast

ratios and faster response times at the same time offering a

thinner and lighter display module, compared to a TFT LCD display.

AMOLED can also support flexible-display forms and

fingerprint-on-display—features that TFT LCDs cannot provide.

On top of those advantages, current market conditions favor AMOLED:

the number of suppliers capable of producing flexible AMOLED is

growing, the quality of AMOLED display panels is improving, and

AMOLED panel prices are gradually decreasing. All told, these

factors have led smartphone OEMs to adopt flexible AMOLED in

growing volume for their premium and high-end line of

smartphones.

Huawei’s use of AMOLED for its two newest smartphones confirms

the company’s commitment to AMOLED technology, with significant

implications for AMOLED manufacturers. Despite being among the

world’s top 3 smartphone companies by shipment volume—it moved

up recently to second place after sweeping past Apple and now just

trails Samsung—Huawei’s adoption rate of AMOLED is relatively

low among the world’s top 5 smartphone manufacturers.

For years, Huawei opted to use TFT LCD displays for its high-end

models, not AMOLED. When competitors began adopting AMOLED for

their premium lines, Huawei stood firm and did not change its

strategy on TFT-LCD. Huawei’s shift to AMOLED—first with the

P20 phones and now with the P30 models—should then be viewed

with great interest. It is the clearest signal yet—to the

displays market and to other smaller display manufacturers watching

to see how Huawei would act—that the world’s No. 2 smartphone

manufacturer is now fully committed to AMOLED as the display

technology of choice for its premium phones.

That, in turn, can motivate AMOLED makers everywhere to step up

production of AMOLED panels. The end-result could see AMOLED makers

increasing their share of the smartphone displays market—a most

welcome win for the AMOLED space.

Brian

Huh is principal analyst for small/medium displays at

IHS Markit

Posted 1 July 2019